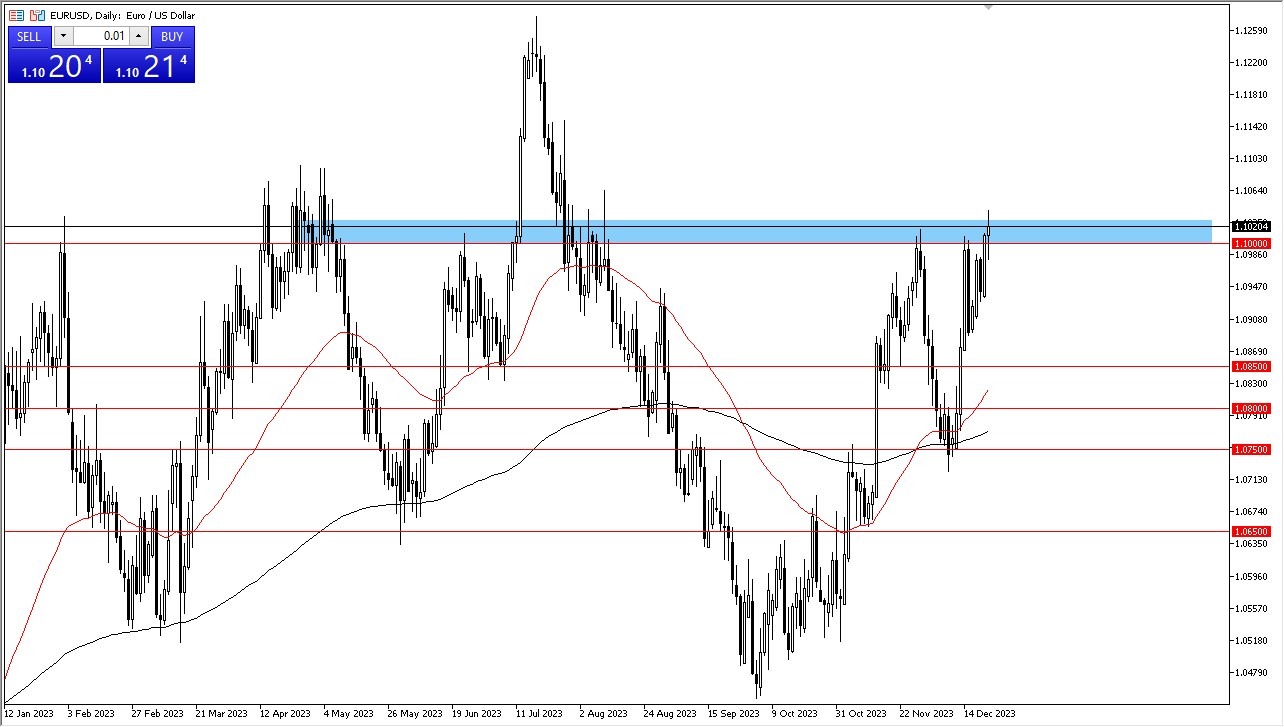

- The EUR/USD had a slight setback during Friday's trading session but quickly rebounded, indicating renewed strength in the currency.

- In simple terms, this suggests that many buyers view the euro as a favorable bargain at its current price and are keen to purchase it before it becomes more expensive.

- If the euro manages to surpass the highest price it reached on that day, it could set its sights on a significant level known as 1.1250. However, it's important to note that during the holiday season, significant market shifts may be limited over the next few days.

Top Regulated Brokers

The 1.1250 level holds particular significance as it previously acted as a formidable resistance point, impeding the euro's upward trajectory. Therefore, it's logical for traders to target this level as a potential objective. Another crucial factor supporting the euro's potential rise is the likelihood of the United States reducing interest rates next year. Lowering interest rates tends to weaken the U.S. dollar, which can, in turn, bolster the euro's strength. Conversely, if the market experiences a downturn, the euro may find support at 1.0950, and even more substantial support awaits at 1.0850.

Buying the Dips

In essence, the prevailing market sentiment suggests that buying the euro when its price experiences short-term dips could be an attractive strategy. The breakthrough above the recent high implies that the market is poised for further upward movement. While traders will remain attentive to brief declines in price, the overall trend indicates a market that is determined to revisit its highest point. However, it's crucial to closely monitor the reasons behind the United States' interest rate cuts. If these cuts are a response to a significant global recession, it could prompt traders to favor the U.S. dollar, potentially altering the market's direction.

In the short term, though, the most probable destination for the euro appears to be the 1.1250 level in the coming weeks or months. This level represents a significant milestone that traders have their eyes on. While market dynamics can change rapidly, this level serves as a beacon for those looking to understand the euro's trajectory. In summary, the euro's recent resilience and potential to break through key levels underscore its potential for further gains. As the holiday season unfolds, the market may experience a lull in activity, but the euro remains poised to continue its journey towards 1.1250 in the foreseeable future.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.