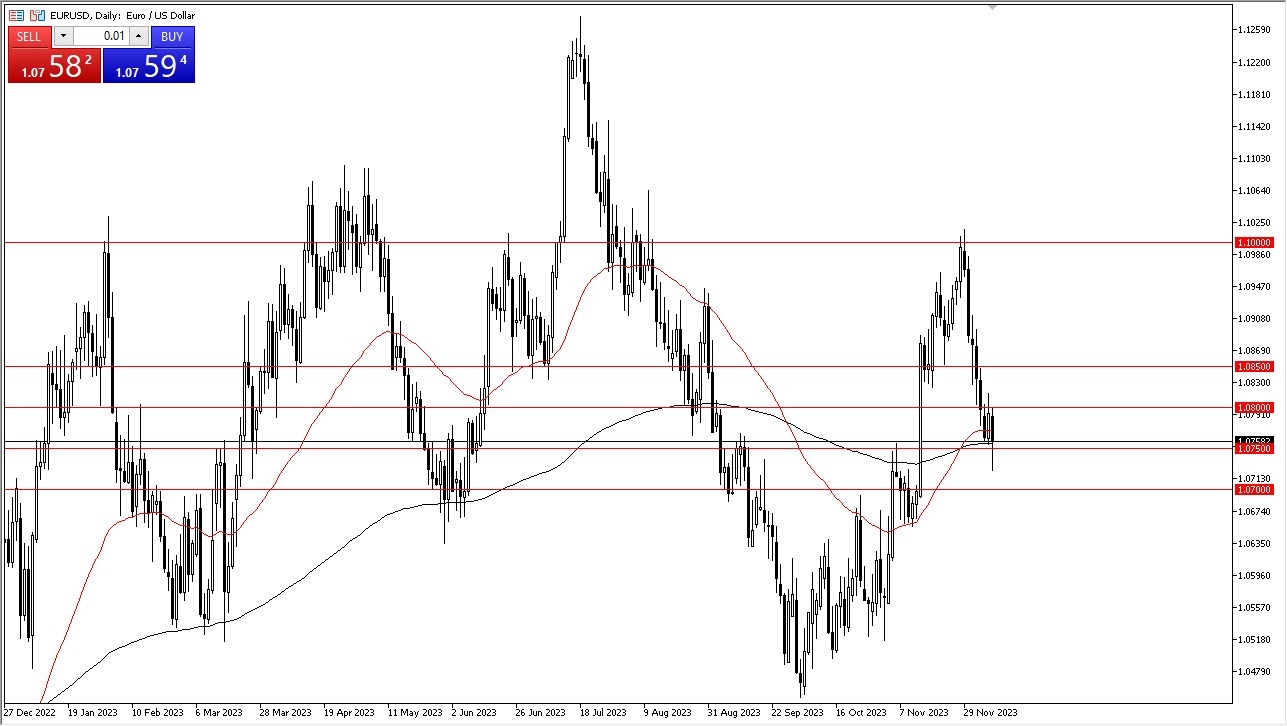

- The EUR/USD had a rough ride during the latest trading session on Friday. It experienced a sharp decline, breaking below the critical 1.0750 level.

- However, it appears that there is a support base forming beneath this level, thanks to a handful of buyers who are determined to keep the market from plummeting further.

- This has created a sense of cautious optimism among traders, though the overall outlook remains clouded by uncertainty.

Top Regulated Brokers

The next potential target for the euro's downward movement is the 1.07 level. If the current trend persists, this could spell trouble for the euro, erasing the gains made by the bullish candles observed a couple of weeks ago. Such a development would undoubtedly be viewed as a negative turn of events. Conversely, if there's a rally from the current position, traders may set their sights on the 1.08 level as a potential upside target.

Bond Markets

In this turbulent market, one key factor influencing the euro's trajectory is the bond market. The euro often takes its cues from the performance of US bond yields, which can rise or fall and cause significant momentum swings. However, recent fluctuations in bond yields have left the market in disarray. Some believe that falling bond yields may indicate an impending recession, making the US dollar more attractive as a safe haven, leading to increased demand for bonds.

Adding to the confusion is the recent US jobs report, which revealed stronger-than-expected numbers. This development has shifted traders' focus towards the US dollar as a safer option compared to the beleaguered eurozone, which is already grappling with recessionary pressures. The ongoing economic challenges in the European Union have further diminished the appeal of the euro.

As we approach the holiday season, market dynamics are expected to become even more unpredictable. The festive period typically leads to reduced liquidity as traders take time off, making it essential to exercise caution when determining position sizes. The uncertainties surrounding both the euro and global markets, coupled with the influence of the bond market and economic data, make it a challenging landscape for traders to navigate.

In the end, the euro faces a rocky road ahead, with numerous factors contributing to its volatility. Traders must remain vigilant and adaptable in these uncertain times, keeping a close eye on both economic developments and the bond market, as they seek to make informed decisions in the ever-changing landscape of the foreign exchange market.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.