- The crude oil markets underwent a period of tight range trading on Friday, as they continued to probe the upper bounds of their consolidation zones.

- Both the West Texas Intermediate (WTI) Crude Oil and Brent Crude markets are experiencing a delicate balancing act, with various factors impacting their near-term outlook.

Top Regulated Brokers

WTI Crude Oil is currently hovering at the top of a short-term trading range. The critical obstacle to overcome is the $72.50 level. A successful breach of this level could pave the way for a rally towards the $75 mark. Conversely, the $68 level offers significant support beneath the market. In the short term, it's reasonable to expect some back-and-forth trading as traders attempt to establish a solid foundation.

A Potential Recession?

However, the shadow of a potential U.S. recession looms over the oil market. If a recession were to materialize, it could exert downward pressure on crude oil prices. The market's performance is therefore influenced not only by technical factors but also by broader economic indicators.

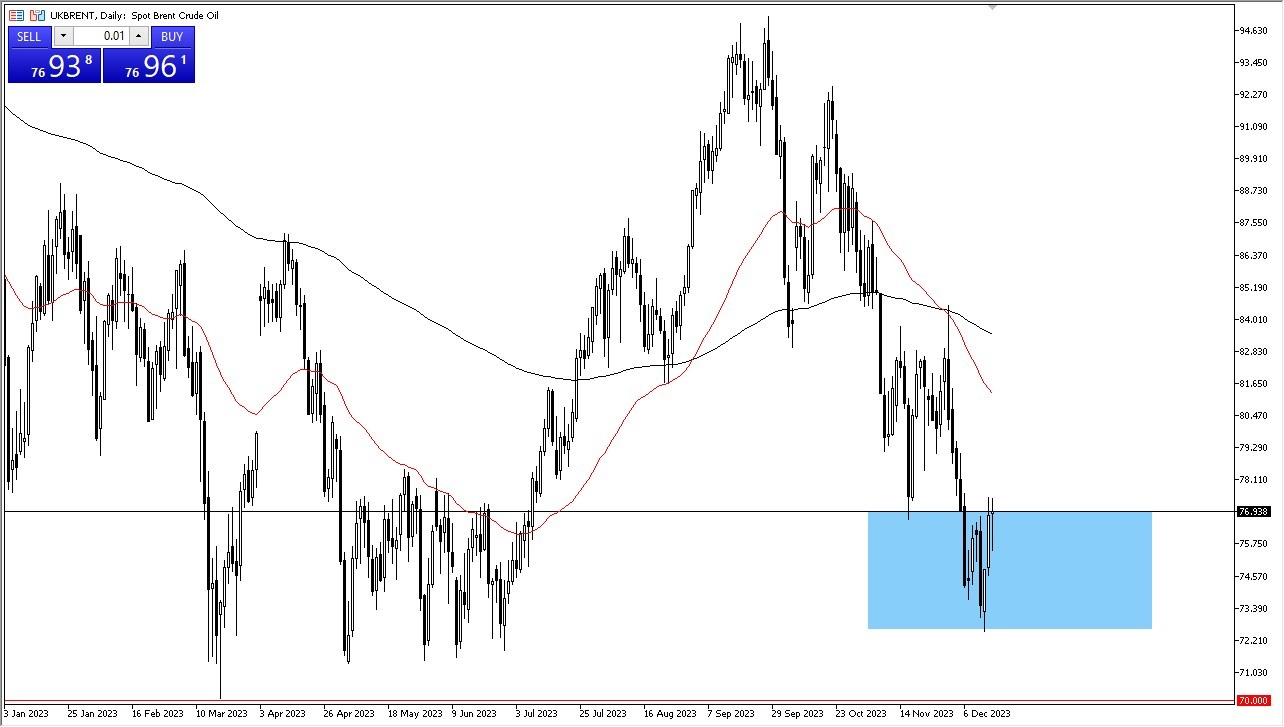

Turning to the Brent Crude market, it has encountered resistance near the $77 level. A decisive break above this resistance could set the stage for a further climb towards $80. The presence of the 50-day Exponential Moving Average (EMA) in this area adds to the significance of this level. Conversely, if the market retreats, there is potential support around the $73 mark.

In a broader context, both WTI and Brent markets appear to be consolidating, a pattern that aligns with Dow theory's notion of accumulation. Traders are likely viewing this consolidation as an opportunity to build positions, seeking value in the market. Additionally, the $70 level serves as a major support floor on longer-term charts, reinforcing its significance.

Ultimately, the direction of crude oil prices remains sensitive to the looming specter of a recession. Investors and traders will closely monitor economic indicators and market developments to gauge the potential impact on oil demand. As the markets test their boundaries, traders should stay vigilant and adapt their strategies to the evolving dynamics of the crude oil market. The markets will be noisy in the last few weeks of the year, but ultimately, I think that we are very close to the bottom. This is a situation where traders could be into the idea of trying to find value in this commodity.

Ready to trade WTI Crude Oil FX? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.