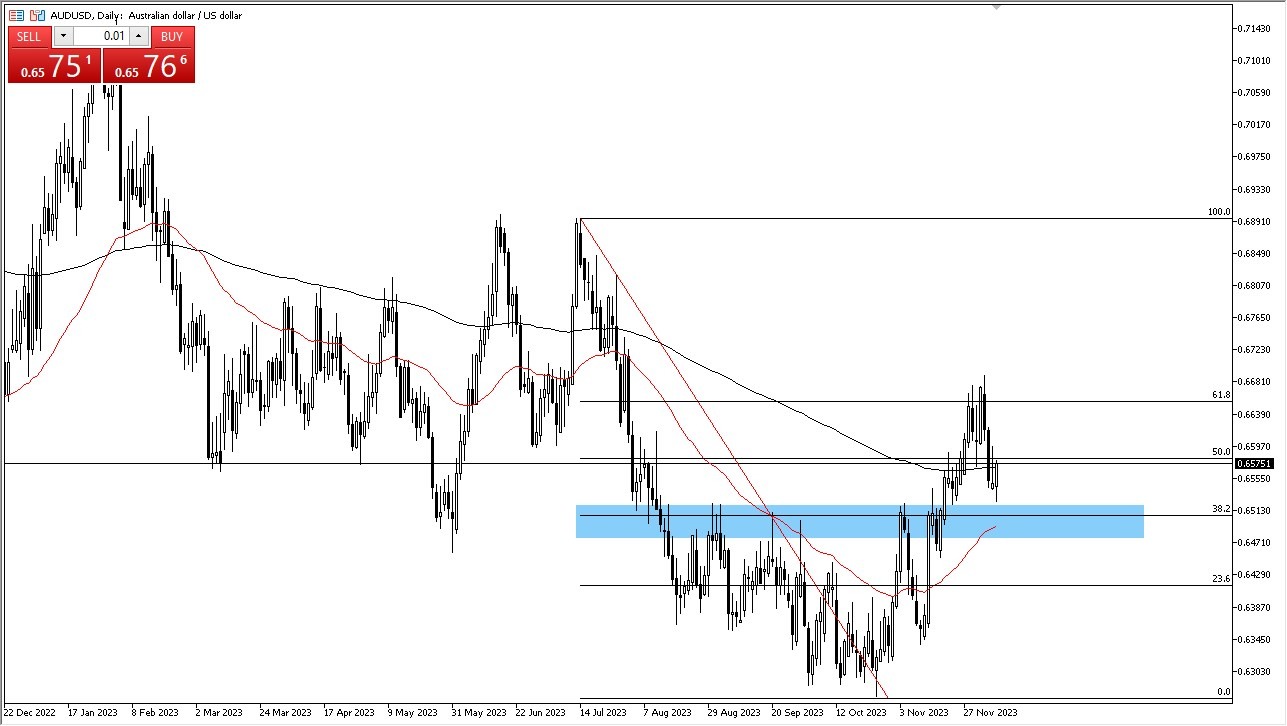

- The AUD/USD experienced a slight dip in its value during the recent trading session, hovering just above the 0.65 level.

- However, there are indications of a potential turnaround, with the currency breaking above the 200-Day EMA once again. Market observers are now closely watching for a key bullish signal: a break above the high of the previous candlestick.

- If this occurs, it could pave the way for a significant uptrend, potentially pushing the Australian dollar toward the 0.67 level and beyond.

Top Regulated Brokers

The upcoming Friday session is set to be a pivotal moment for currency traders as it will feature the release of Non-Farm Payroll numbers. This economic data could catalyze significant market movements. Currently, the driving force behind market dynamics is the interest rates in the United States. As these rates continue to decline, it raises the possibility of the Australian dollar gaining strength and subsequently weakening the US dollar.

Despite the potential for robust gains, it's important to note that this market remains characterized by volatility. The recent swing high, if breached, could lead the Australian dollar towards the 0.69 level. Conversely, there is notable support around the 0.65 level, marked by the 50-day EMA. A breakdown below this level would signify a negative turn of events and could influence market sentiment adversely.

Fed and Monetary Policy

One of the prevailing assumptions in the market is that the Federal Reserve is poised to adopt a more accommodative monetary policy. While the actual actions of the Federal Reserve are yet to be seen, the market seems to be anticipating looser monetary policies, which typically favor the Australian dollar. This anticipation is grounded in the belief that looser policies encourage riskier investments and the Australian dollar is often linked to commodity markets and Asian economic growth, making it an appealing choice for investors seeking higher returns.

At the end of the day, the Australian dollar market is poised for potential volatility shortly, with Friday's Non-Farm Payroll numbers likely to be a pivotal event. The interplay between interest rates in the United States and the market's expectations regarding Federal Reserve policy will continue to influence the currency's performance. While the Australian dollar may experience fluctuations, the prevailing sentiment appears to favor its ascent, especially if it manages to surpass recent highs.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.