- The AUD/USD continues to demonstrate significant volatility as market analysts and traders try to decipher its next trajectory. This uncertainty is mirrored in the global bond markets, which are exhibiting fluctuating trends, suggesting a growing anticipation that the Federal Reserve might initiate rate cuts as soon as March.

- Such a development would likely weaken the US dollar, inadvertently benefiting the Australian dollar. However, recent movements in bond markets indicate a reconsideration of this outlook.

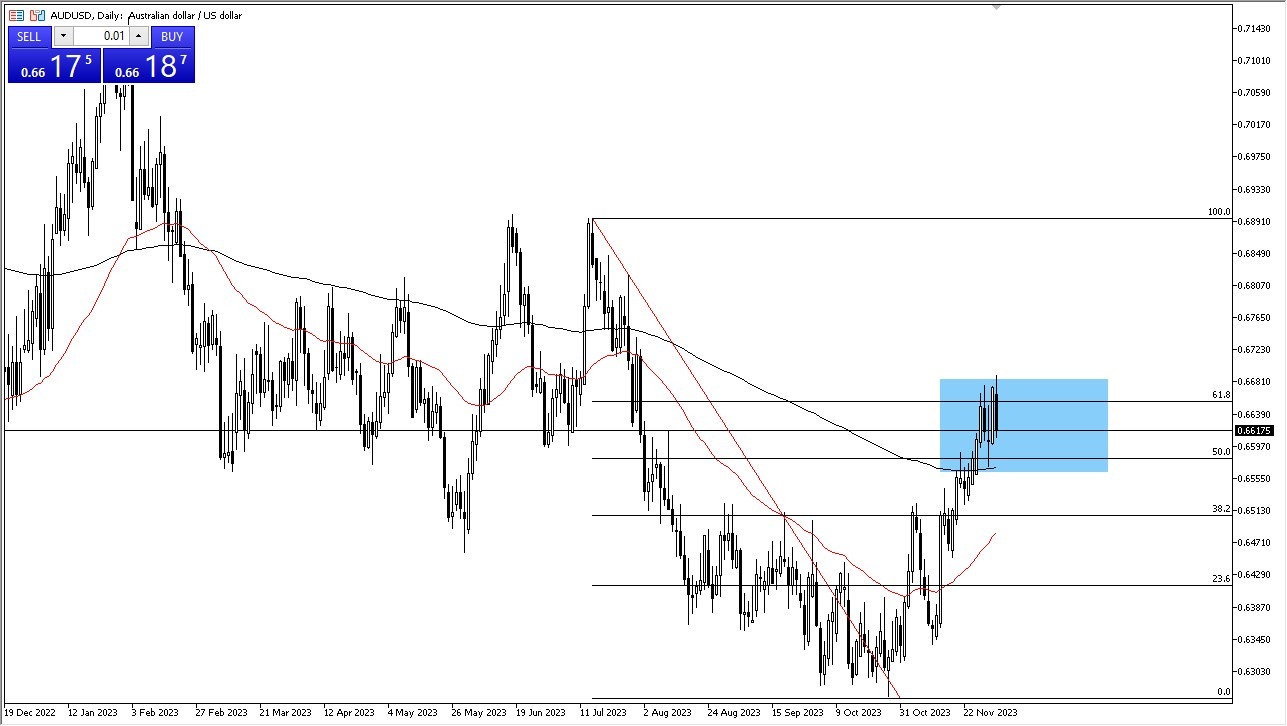

- This change is seen as a short-term fluctuation, with substantial support observed near the 200-Day EMA and the psychologically crucial 0.66 level.

Top Regulated Brokers

The Upside Scenario

On the upside, a breakthrough above the recent highs of the last couple of candlesticks could signal a potential surge, possibly aiming for the 0.69 level. This threshold has historically served as a formidable resistance point. Surpassing this level might shift the strategy to a more prolonged 'buy-and-hold' stance. Yet, current market conditions do not strongly indicate such a breakout. The prevailing sentiment suggests a period of oscillation as the market seeks a clear direction. However, once momentum is established, a significant 'fear of missing out (FOMO)' trade is anticipated. Although the Australian dollar has shown robust performance recently, it seems to be in a phase of correcting its overvaluation, hinting at a probable range-bound movement with a slight upward inclination. A drop below the 0.65 level could lead to a more pronounced market downturn.

It is crucial to recognize that the Australian dollar is intricately connected to the commodity markets and, by extension, to the economic dynamics of Asia. This linkage necessitates a multifaceted analytical approach, considering various factors simultaneously. These include not only the local economic indicators but also the broader implications of bond market trends in the United States and the corresponding yield fluctuations.

Given these complexities, investors and traders must maintain a vigilant eye on a range of economic indicators and global market trends. This will continue to make the Aussie difficult at times. The interplay of these factors will be pivotal in shaping the Australian dollar's trajectory in the coming days, especially now that we are in the December month. As the global economic landscape continues to evolve, particularly with potential shifts in the Federal Reserve's policies, the ripple effects on currencies like the Australian dollar will be significant and warrant close monitoring for informed decision-making.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.