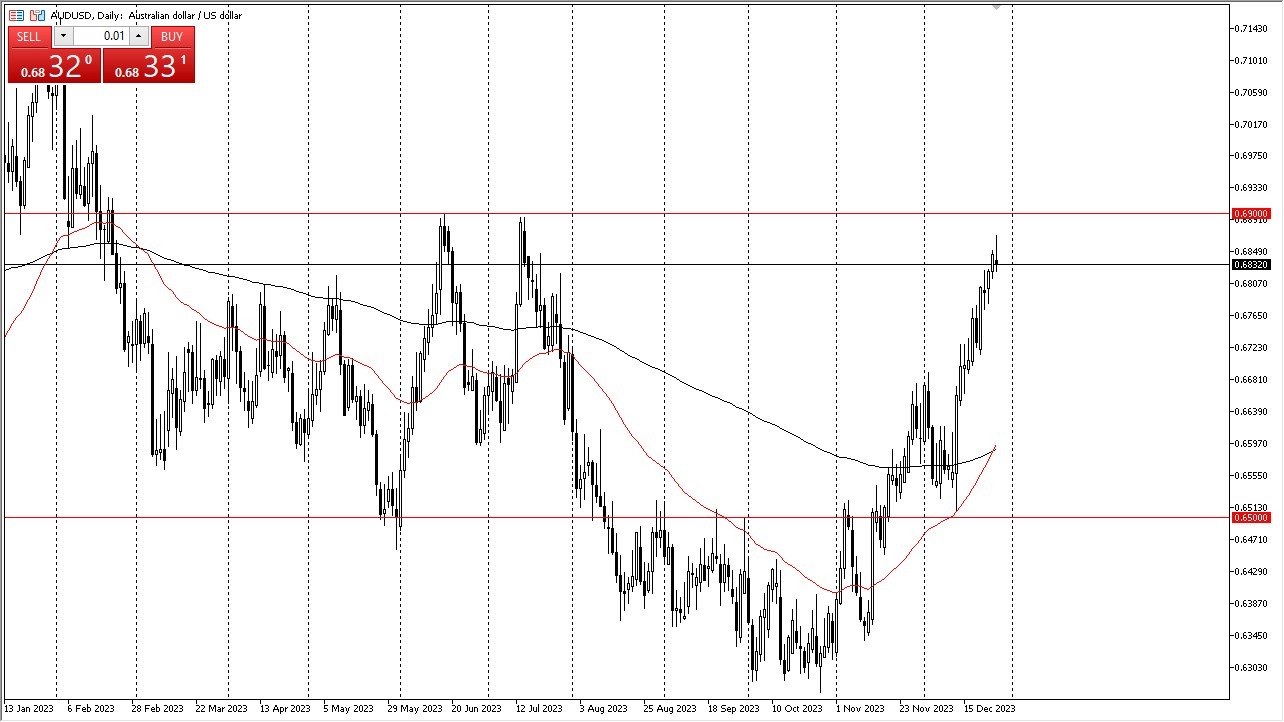

- The AUD/USD exhibited an initial attempt at a rally on Thursday, although it appears to have encountered a temporary loss of momentum.

- This development is not entirely unexpected, considering the sustained upward trajectory that the currency has experienced.

- In the world of finance, the force of gravity eventually asserts itself, leading to pullbacks and retracements.

Top Regulated Brokers

It is crucial to closely monitor the 0.69 level, which serves as a significant resistance barrier. The Australian dollar's performance currently raises several questions, given its strong linkage to commodity markets and global economic growth. While concerns about the latter have been prevalent, recent market focus has largely revolved around the Federal Reserve's actions.

The anticipation of interest rate reductions in the United States during 2024 has prompted traders to position themselves ahead of the Federal Reserve's actions, resulting in shorting of the US dollar. However, it is important to recognize that if rate cuts are implemented due to economic uncertainties, this could ultimately favor the US dollar in the long run.

Economic Headwinds Coming in 2024? Maybe Later

Despite the Australian dollar's recent strength, it may encounter headwinds in an economic environment marked by potential challenges. As a commodity currency with significant ties to China, which, in turn, is closely interconnected with the global economy, the Australian dollar's performance is influenced by broader economic dynamics.

In terms of technical levels, a pullback is anticipated, with the 0.6680 level emerging as a critical support zone. The holiday season introduces a degree of liquidity constraint, adding an element of unpredictability to market movements during this period. However, I think overall the AUD/USD pair will continue to look more positive than negative in the near term.

At the end of the day, the Australian dollar's recent performance involved an initial rally attempt, followed by a momentary loss of momentum. The 0.69 level remains a pivotal point to monitor. The currency's performance is intricately tied to both commodity markets and global growth prospects. While the focus has largely centered on the Federal Reserve's actions, the longer-term trajectory of the Australian dollar may be influenced by the underlying economic landscape. A pullback is expected, with the 0.6680 level serving as a significant support level. However, it is essential to exercise flexibility and caution during the holiday season, as market dynamics can be influenced by reduced liquidity.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.