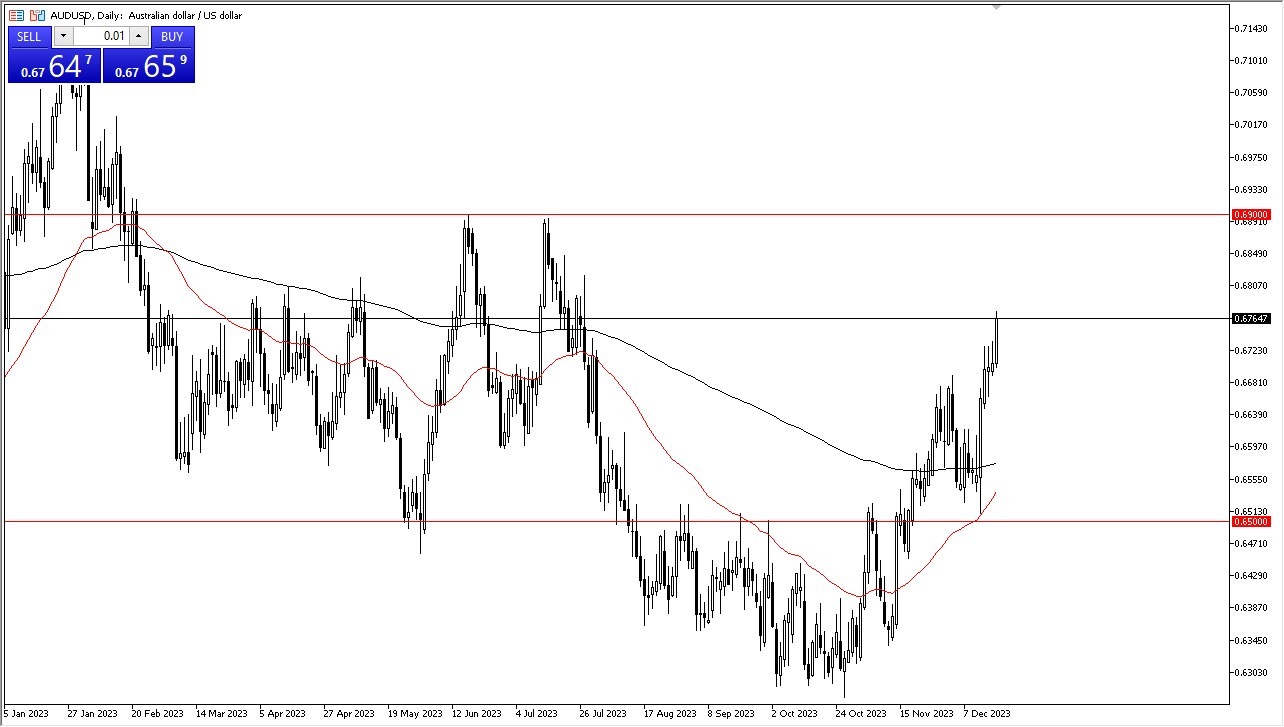

- The AUD/USD showcased its resilience during the most recent trading session, surging once again and breaking the previous couple of candlestick highs.

- This bullish momentum suggests that the currency is poised to ascend further, with the 0.69 level emerging as the next significant target.

- This level, once a formidable resistance barrier, could potentially mark the apex of the broader consolidation phase currently underway.

Top Regulated Brokers

In the short term, any pullbacks are likely to attract value-seeking buyers, driven in part by expectations surrounding the Federal Reserve's interest rate policy. Despite certain members of the Fed attempting to temper these expectations, the prevailing sentiment now points to a possible rate cut in 2024. Beneath the surface, the 50-Day Exponential Moving Average is steadily climbing, positioning itself to surpass the 200-Day EMA, a development often referred to as the "golden cross" – a signal revered by long-term traders for its bullish connotations. This is a lagging indicator, but those who think in terms of quarters and even years will be paying close attention to this.

Pullbacks Coming

The ongoing trend of short-term pullbacks offering buying opportunities is a testament to the market's optimism, particularly in light of the Federal Reserve's interest rate outlook. This dovish stance is diminishing demand for the US dollar, propelling the Australian dollar and other currencies in an upward trajectory. However, when looking beyond the immediate future, concerns emerge regarding the global economy's influence on the Australian dollar, as it remains intricately linked to both the global economic landscape and the volatile commodity markets.

A crucial factor to monitor closely is the trajectory of bond yields in the United States. A continued decline in bond yields is likely to exert additional downward pressure on the US dollar, thereby strengthening not only the Australian dollar but also other currencies worldwide. Consequently, the Australian dollar's ascent is intertwined with this pivotal aspect of financial markets.

In the end, the Australian dollar's impressive run continues, underpinned by an array of factors ranging from Fed rate cut expectations to global economic dynamics. Short-term buying opportunities persist, and the 0.69 level remains a focal point. While the path forward may not be without challenges, the prevailing sentiment suggests that this currency is determined to grind higher, making it a compelling market to watch in the coming weeks.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.