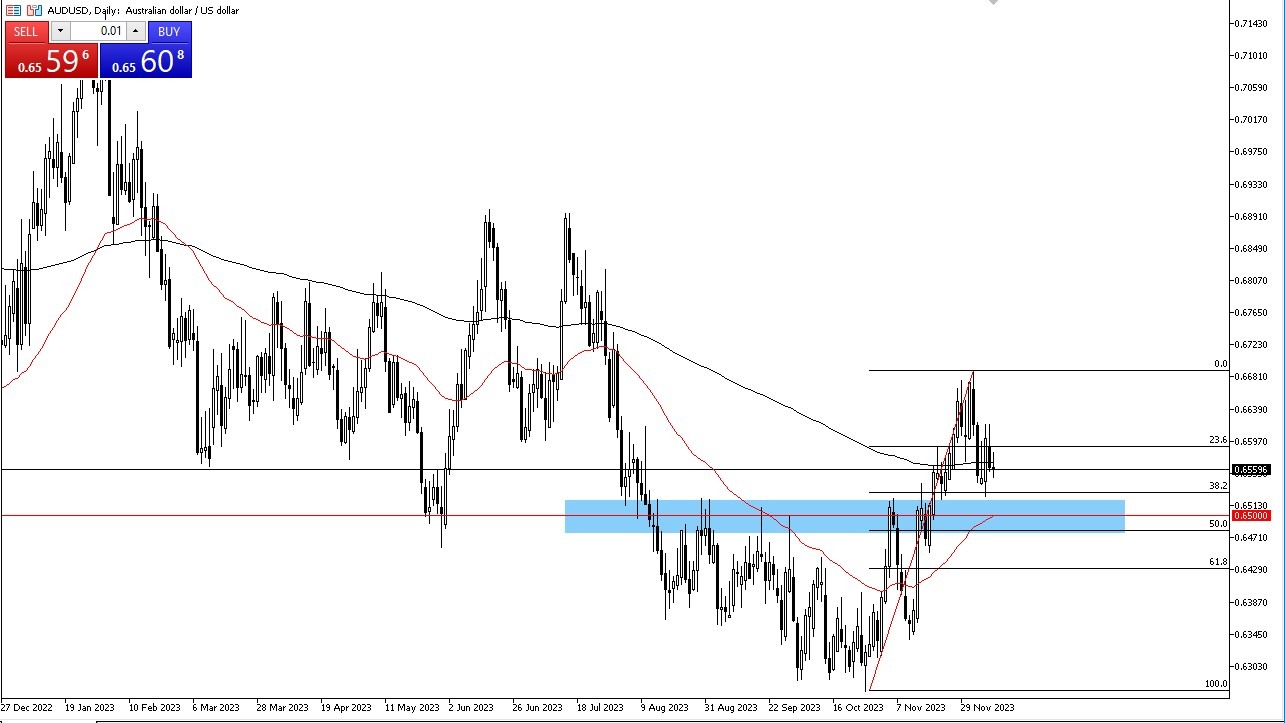

- In the early hours of Monday, the AUD/USD engaged in a fluctuating dance around the 200-Day EMA.

- Beneath this activity lies a significant support level at 0.65, with the 50-Day EMA also situated in close proximity.

- Slightly above, at the 0.66 level, some resistance is encountered, followed by the 0.67 level.

Top Regulated Brokers

The market remains characterized by considerable volatility, a phenomenon that can be attributed to various central banks scheduled to make announcements throughout the week, notably the Federal Reserve – which traders continue to try to force into easing. Additionally, year-end liquidity concerns are emerging, and this factor deserves careful consideration. It is evident that inquiries into risk appetite will persist in this scenario. Subsequently, after this week, liquidity is likely to wane as market participants shift their focus towards the upcoming holidays. In essence, it is reasonable to anticipate a period where the market settles within this general range.

Caution Urged Amid Market Oscillation and Liquidity Risks

Nevertheless, it is essential to acknowledge that a substantial market order could significantly influence the market's direction if liquidity experiences a substantial reduction, prompting brokers to execute these trades. The candlestick pattern from Monday's session aptly reflects the market's ongoing oscillation. Ultimately, this market is poised to remain sensitive to risk sentiment, with the Australian dollar serving as a sort of "risk gauge" within the currency markets. In light of this, it is advisable to exercise caution in determining position size, as the potential for swift exits from trade exists. Afterall, the markets are essentially short-term gambling at this point in time.

In the end, the Australian dollar's recent trading activity has been characterized by a back-and-forth movement, particularly concerning the 200-Day EMA. Key levels of support and resistance at 0.65 and 0.66, respectively, have contributed to this dynamic. The market is currently experiencing heightened volatility due to central bank announcements and year-end liquidity considerations. As the week progresses, the focus is expected to shift toward holiday-related factors, potentially leading to a period of relative stability within the market. However, traders should remain cautious, as a significant market order could still sway the market's direction in the face of reduced liquidity. Overall, the Australian dollar's performance continues to be closely tied to risk sentiment in the broader currency markets, emphasizing the need for prudent position sizing to navigate potential fluctuations and unexpected developments.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.

Ready to trade our daily Forex analysis? Check out the best forex trading platform for beginners Australia worth using.