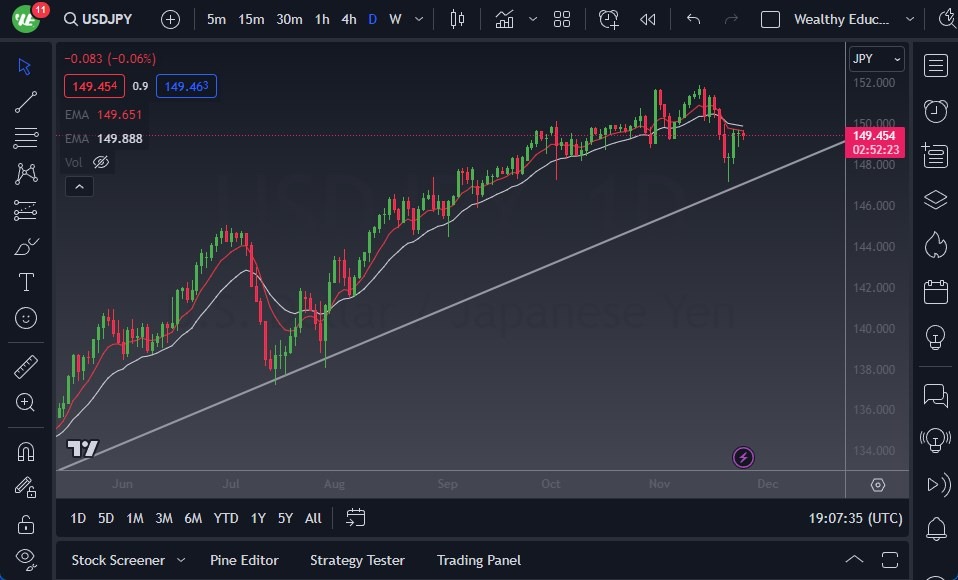

- In the Friday trading session, the USD/JPY initially experienced a decline, but significant support near the 50-Day Exponential Moving Average suggests a potential reversal.

- The market is gearing up to challenge and possibly surpass the ¥150 level.

- The quiet trading atmosphere over the last couple of days, influenced by the Thanksgiving holiday and the typically subdued Friday trading in America, is noteworthy. However, the ¥147.80 level has emerged as a crucial support point, catalyzing the dollar's recovery.

Top Regulated Brokers

Observing the broader currency markets, it's evident that the Japanese yen remains weaker compared to most currencies, which are appreciating against it. This trend is expected to continue, with the market likely to exhibit volatile, or 'noisy', behavior before returning to previous highs. The interest rate differential still favors the US dollar, despite a recent dip in rates. This scenario diminishes the appeal of the Japanese yen, particularly against the US dollar, which also holds the status of a safe-haven currency.

The market is anticipated to display significant volatility, but there is a strong undercurrent of buyers eager to capitalize on the perceived value of the US dollar at lower prices. Any general strength of the US dollar against other currencies could further benefit the USD/JPY pair. Consequently, the expectation is for this pair to rise significantly in value.

Leveraging the Persistent Strength of the USD/JPY Pair

- A breakthrough above the ¥152 level would set the stage for the next target at the ¥155 level.

- While the US dollar's rise against the yen may not be as rapid as other currencies, the overall trend is unmistakably upward.

- The consistent pattern of buyers stepping in during dips reinforces the notion that investing in this currency pair is a sound strategy.

In the end, the US dollar's trajectory against the Japanese yen is marked by stubborn resilience and potential for momentum to the upside. The support at the 50-Day EMA and the ¥147.80 level, combined with the favorable interest rate differential and the dollar's safe-haven appeal, all contribute to a bullish outlook for the USD/JPY pair. Investors and traders are likely to find opportunities in this pair's fluctuations, with a general trend towards higher values. As the market navigates through its volatility, the strategy of 'buying the dips' seems particularly prudent in capitalizing on the US dollar's strength against the Japanese yen, as well as the overall lack of strength in Japan.

Ready to trade our Forex daily forecast? We’ve shortlisted the best FX trading platform in the industry for you.