Top Regulated Brokers

Today's recommendation on the TRY/USD

Risk 0.50%.

Best buying entry points

- Entering a buy deal with a pending order from the 28.35 level.

- Place a stop loss closing point below the 28.20 level.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the strong resistance levels at 28.70.

Best-selling entry points

- Entering a sell deal with a pending order from the 75.28 level.

- The best points to place a stop loss are closing the highest level of 28.85.

- Move the stop loss to the entry area and follow the profit as the price moves by 50 points.

- Close half of the contracts with a profit equal to 70 points and leave the rest of the contracts until the support level of 28.40.

The price of the Turkish Lira declined against the US dollar during early trading on Tuesday morning, as the pair recorded new lows. Investors followed the statements of Turkish Finance Minister Mehmet Simsek, who commented on inflation after recent updates that revealed a slowdown in the consumer price index in Turkey. The Turkish minister said that the government will control inflation rates significantly, as we work to reduce it within a period of one year from now, and we also seek to close the current account deficit. Simsek concluded his statements by commenting on the improvement in Turkey's credit rating, saying that this improvement occurred while we are still in an early stage of change, and we still expect the best in light of the global financing environment that supports us.

The latest reports revealed that the S&P credit rating agency changed its view of the Turkish banking sector from (negative) to (stable), as the agency’s report attributed this progress to the improvement in imbalances and risks in the banking sector. The report also included expectations that the Turkish economy would restore its balance within a medium period of time, if adherence to the gradual tightening continued. Finally, the agency’s report expected the price of the dollar to rise against the lira, bringing the dollar to levels of 40 lira during 2024.

TRY/USD Technical Analysis

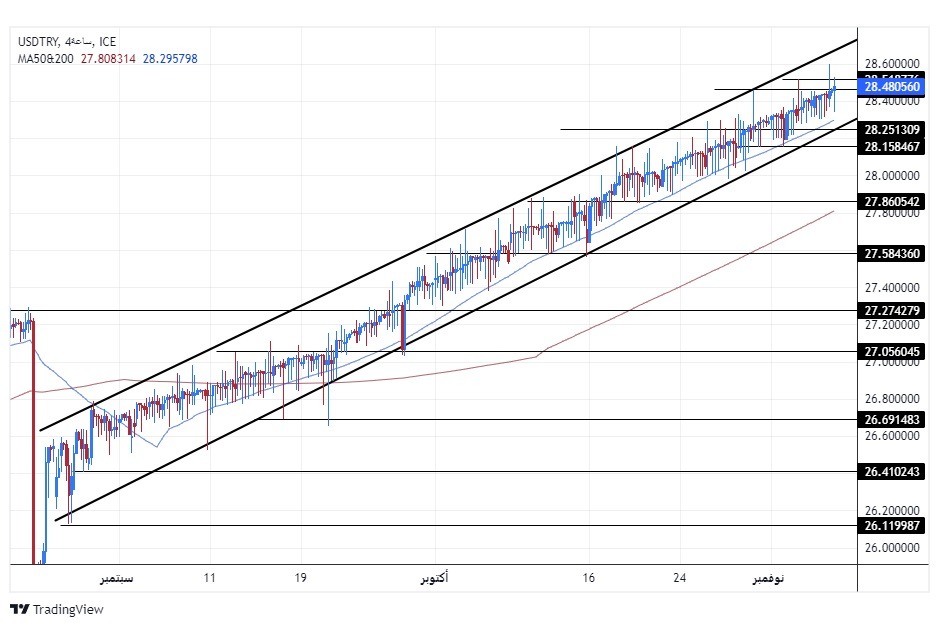

On the technical level, the dollar pair rose against the Turkish lira during Asian trading this morning, as the pair recorded its new highest level ever at levels of 28.60 liras per dollar, while the pair maintained its movements within an ascending price channel on today’s time frame shown in the chart.

Currently, if the pair goes up, it targets the resistance levels concentrated at 28.75 and 29.00, respectively, while if the pair declines, it targets the support levels concentrated at 28.10 and 27.90, respectively. The price is moving above the 50 and 200 moving averages on the daily time frame, as well as on the four-hour time frame, indicating the control of buyers and the general upward trend recorded by the pair. The pair is expected to record gains as long as it settles within the ascending price channel range. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.