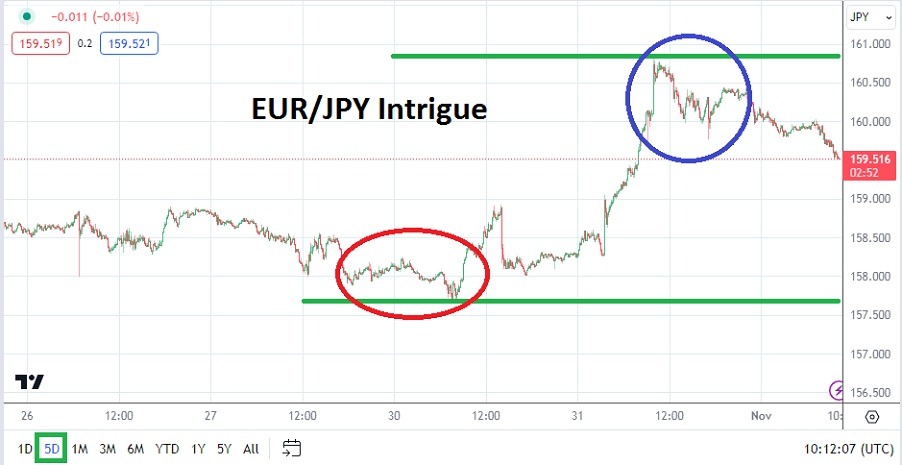

The EUR/JPY is near the 159.560 level as of this writing. Yesterday a high of 160.875 was attained, which puts the EUR/JPY into the vicinity of a price apex it has not traversed since September 2008. The trend in the EUR/JPY since late March of this year has been pronounced. However, in late August the EUR/JPY flirted with the 160.000 mark only to be propelled lower and hit the 154.500 level with extreme price velocity lower on the 3rd of October.

Top Regulated Brokers

Since experiencing the lows of early October, the EUR/JPY has steadily climbed again, yes, with the typical reversals major currency pairs produce daily. Day traders who believe they have the capability to jump into the upward trend cannot be blamed, but they should note the Bank of Japan is lurking in the background and capable of an intervention that could make the JPY stronger momentarily – thus making the EUR/JPY weaker.

EUR/JPY Trading above the 160.000 Level is Significant

Day traders should take a look at a long term chart of the EUR/JPY, but they should not grow too aggressive regarding their pursuing of bullish positions. The 160.000 level in the EUR/JPY is a key psychological mark, but so too is the USD/JPY level of 150.000 in the minds of financial institutions. The ability of the EUR/JPY and USD/JPY to exceed these two important price levels and find sustained trading above is critical. But, again the Bank of Japan is likely watching closely and could act swiftly if they choose.

In the wake of last week’s European Central Bank rather ‘quiet’ monetary policy statement the EUR/JPY did show a sign of a slight selloff and on Monday was trading near the 157.750 level. However, after the Bank of Japan held their central bank meeting and published their outlook the EUR/JPY has shown the ability to trade higher again.

Today the U.S Federal Reserve will release their FOMC Statement, but no interest rate hike is expected. And traders of the EUR/JPY have to understand that the currency pair is affected by USD centric viewpoints. The Fed will not raise rates today, but they may continue to sound aggressive. The question if financial institutions will take the Fed seriously and how will this affect all of Forex.

Aggressive Traders Need to Be Careful with the EUR/JPY

- The higher momentum in the EUR/JPY cannot be dismissed, but financial institutions may grow a bit cautious at the current heights of the currency pair and not want to venture forward with too much buying.

- However aggressive traders who believe more upward momentum is going to develop may be tempted to seek higher ground, but after slight selloffs which takes the EUR/JPY to perceived support levels.

- If the EUR flirts with the 159.000 to 158.750 ratios, this may be a spot where confident traders seek a bit more upside price action.

EUR/JPY Short Term Outlook:

Current Resistance: 1.60190

Current Support: 1.59300

High Target: 1.60990

Low Target: 1.58180

Ready to trade our Forex daily forecast? We’ve shortlisted the best currency trading platforms in the industry for you.