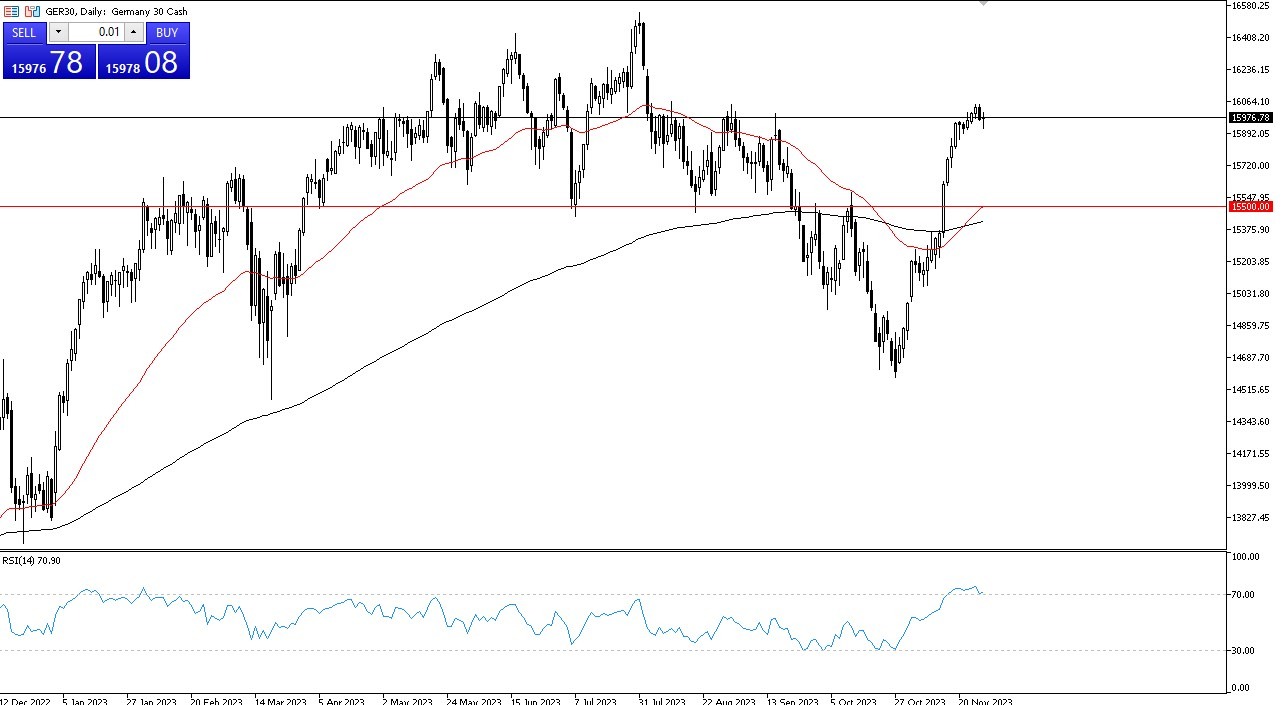

- The DAX found itself very choppy on Tuesday, as the market is starting to approach an overbought condition. The Relative Strength Index is in the overbought region, and it is noteworthy to recognize that that will continue to be something that people will pay close attention to, as the market had gone straight up in the air.

- In fact, you can make that argument about indices around the world, but was particularly interesting about the DAX is that the currency has recently rallied right along with it.

- In other words, the market is likely to continue to be very noisy, but I think it’s probably only a matter of time before we see some type of value hunting on a dip.

Top Regulated Brokers

The market recently experienced the “golden cross”, when the 50-Day EMA crosses above the 200-Day EMA, which is a longer-term bullish sign. That’s a bit of a stretch to say that you should get involved now though, because the market had gained so rapidly. In this overbought condition, I suspect that if you are patient enough, you should get an opportunity to pick up a little bit of value via a dip. Of potential noteworthiness is the €15,500 level underneath, which has been important previously in the past, and also features the 50-Day EMA at the moment. I think given enough time, it’s likely that the market will continue to see that area as being very important.

DAX Faces Critical Juncture at €15,500

If we were to break below there, then it’s likely that we would see quite a bit of selling pressure, but I just don’t see that happening very easily. After all, the market is likely to continue to see downward pressure in that scenario. The €15,500 area has been important multiple times, so I think that of course would be a major inflection point.

On the other hand, if we were to break above the €16,000 level, at least on a daily close, we may try to break above the €16,200 level which is the top of the short-term barrier. Breaking that then could send the market into a nether like higher, but right now I think we are better off looking for short-term pullbacks in order to get long yet again. I anticipate that the DAX will eventually go higher, but you need to find value in a market that is overdone already.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.

Ready to trade our DAX forecast? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.