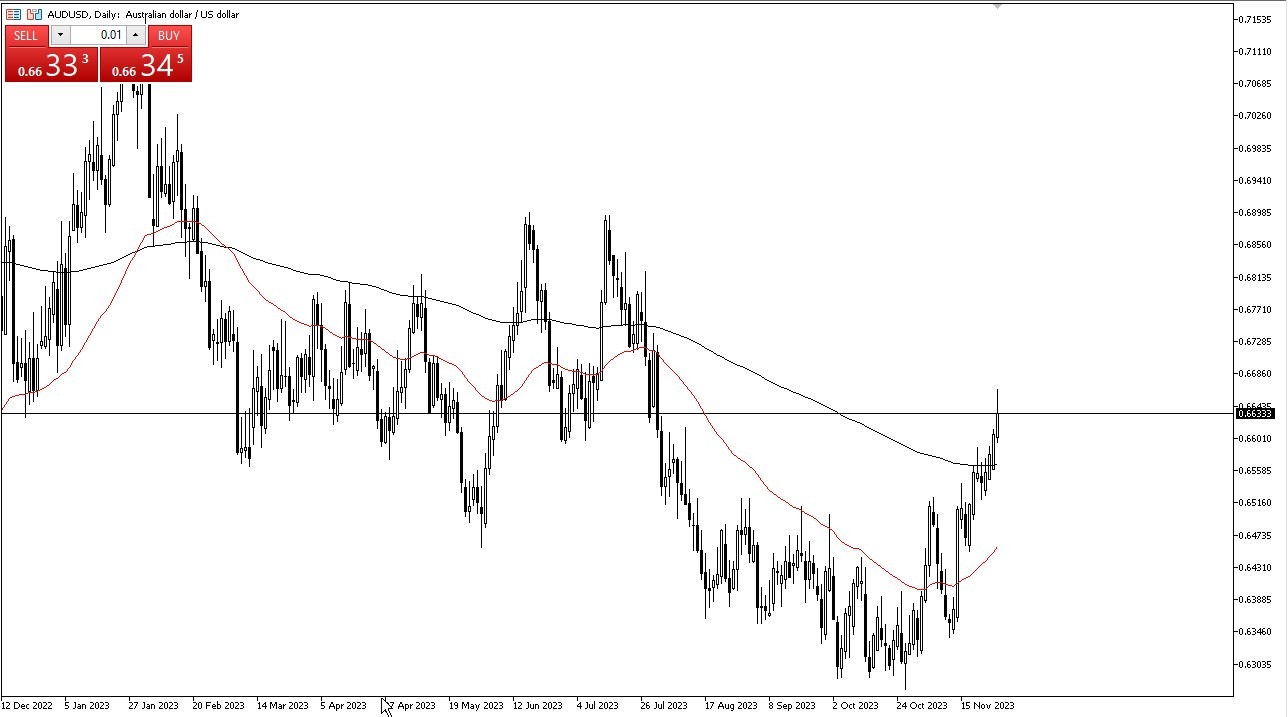

- The AUD/USD has witnessed a notable surge in the course of the trading session, propelling us beyond the pivotal 0.66 level. This juncture holds profound significance, having served as a critical touchstone on numerous occasions in the past.

- The prevailing sentiment suggests that should we manage to maintain our position above this threshold, the market may endeavor to ascend significantly, potentially setting its sights on the 0.69 level as the next milestone.

- It is noteworthy how this development contradicts the historical tendency of the 0.66 level to act as a formidable barrier, at least in the last few months, a testament to the momentum of the market currently.

Top Regulated Brokers

Our current narrative takes shape in the wake of not merely a breach of the 0.66 level but the emergence of a massive candlestick during the Monday session that jumped the 200-Day EMA. These developments undeniably underscore the mounting momentum in favor of the Australian dollar, while concurrently placing the US dollar in a position of relative vulnerability. With this backdrop, we find ourselves in a scenario wherein the potential for this currency pair to advance substantially is becoming increasingly likely. The 0.69 level, positioned as the longer-term significant resistance barrier, beckons as a potential target.

End of the Year “Risk On”

It is essential to temper these expectations by recognizing that this does not necessarily translate into an immediate shot higher. Rather, it intimates the formation of a short-term uptrend, a prospect that aligns with the prevailing year-end market sentiment. Historically, the conclusion of the year tends to usher in a more pronounced "risk-on" inclination, particularly in asset classes such as stocks. While this does not guarantee an unequivocally bullish stance for the Australian dollar, it does reflect a propensity among investors to seek performance gains as the year draws to a close, often exerting downward pressure on the US dollar.

Furthermore, the interest rate trajectory in the United States appears to be signaling a gradual descent, a factor that carries weight in influencing markets. Consequently, traders are likely to approach this situation with a strategic eye, capitalizing on opportunities presented by short-term retracements, at least until the onset of the holiday season. It is important to note that a breakdown beneath the 0.65 level would invalidate this idea. However, as it stands, such an outcome remains an unlikely prospect.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.