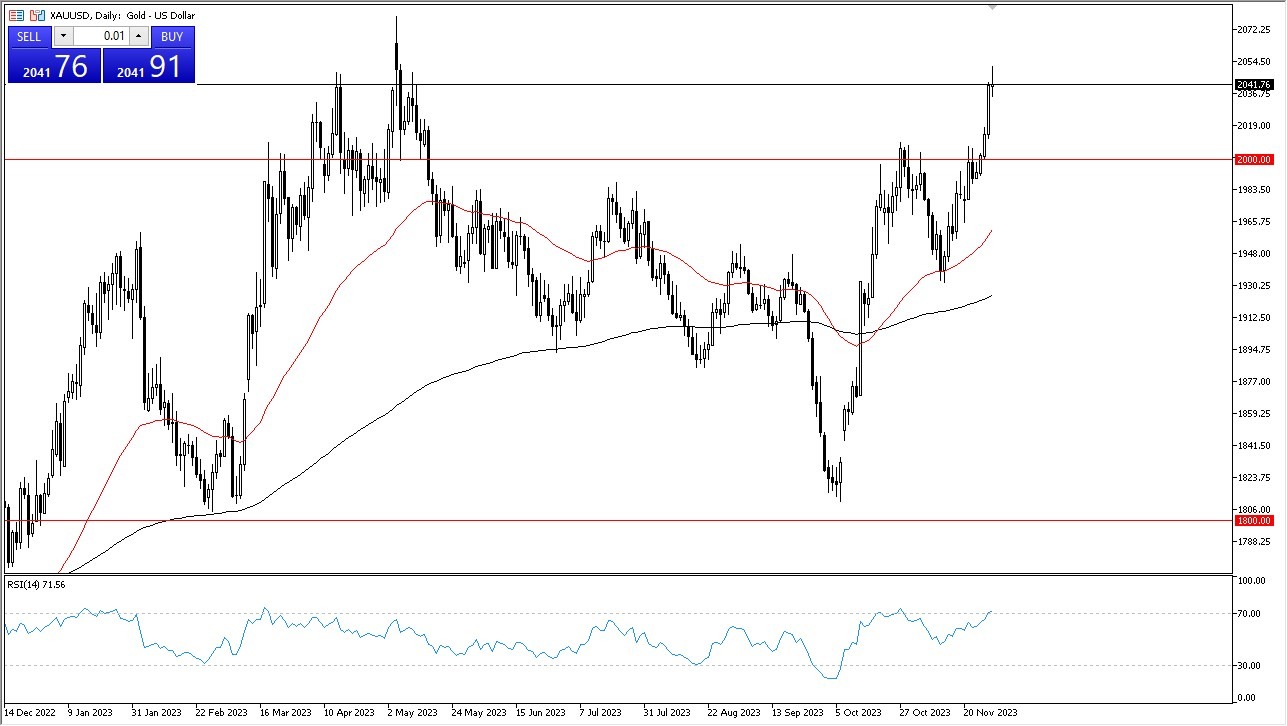

During the trading session on Friday, gold exhibited a rather tepid performance, maintaining its position around the pivotal $2000 mark. This particular price point is undeniably significant, having a psychological impact that cannot be overlooked; it provides a plausible explanation as to why the market appears to be in a state of stagnation at this juncture.

Top Regulated Brokers

Previously, we witnessed gold take an impressive upward trajectory, a movement so rapid that it necessitates a period of consolidation. This need to balance out the previous momentum lends credence to the anticipation of continued choppy trading conditions in the near future. A minor fluctuation of $20 in either direction would still place us well within the bounds of the recent consolidation range, showcasing the current instability of the market.

Looking ahead, a decisive close above the $2000 threshold could very well set the stage for an ascent towards the $2050 level. This particular price point has proven itself to be a formidable barrier in past trading sessions, and it is expected to play a significant role in future movements as well. It is imperative to note the negative correlation that exists between gold prices and interest rates, particularly with reference to the 10-year note in the United States. The U.S. dollar also exhibits a negative correlation with gold prices, adding another layer of complexity to market predictions.

Be Cautious

- Analyzing the current chart reveals the precarious position of the market, prompting traders and investors alike to ponder the future trajectory of gold prices.

- It is important to highlight the apparent weakness in silver prices, a factor that has the potential to exert downward pressure on gold.

- Observing the candlestick patterns, particularly that of Tuesday, becomes crucial under these circumstances. A breakdown below the hammer formed on that day could potentially unleash a wave of selling pressure, causing prices to plummet.

Given the expected increase in market volatility, it is prudent for traders to manage their position sizes judiciously. The ability to weather the potential storm of massive price swings within a confined range will be paramount. Additionally, it is crucial to take into account the impact of geopolitical tensions on market volatility. These external factors, unpredictable as they may be, play a significant role in shaping market dynamics.

In the end, while gold prices appear to be in a state of limbo around the $2000 mark, a large amount of factors, including interest rates, currency movements, and geopolitical issues, continue to influence market behavior. Traders are advised to exercise caution, remain vigilant, and adjust their strategies accordingly to navigate the choppy waters of the gold market.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.