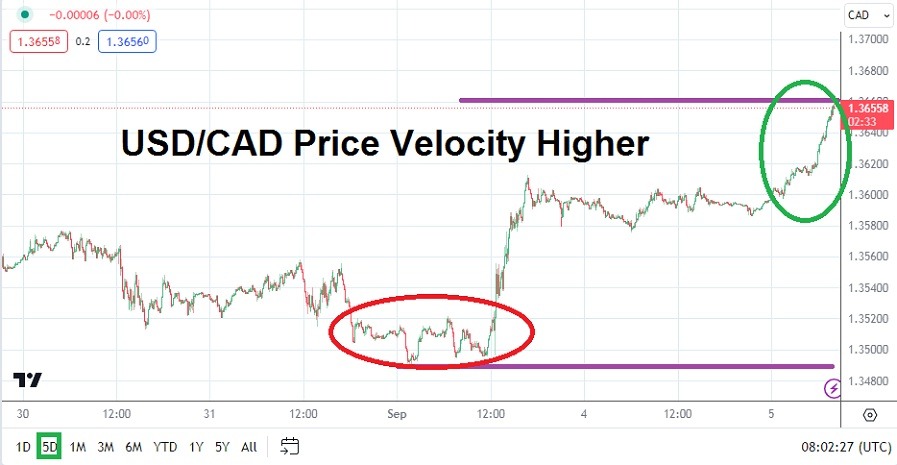

Speculators who were betting on a decline of the USD/CAD early this morning may be looking at their trading screens with a large amount of surprise, as they try to understand the extreme higher price velocity produced the past few hours in the currency pair. The USD/CAD is trading near the 1.36620 mark as of this writing with rather quick changes flashing. The USD/CAD hit a low of 1.34940 on Friday before going up as the day passed.

Top Regulated Brokers

Traders may Blame USD/CAD Price Action on the Labor Day Holiday

Both Canada and the U.S. celebrated Labor Day yesterday. Trading volumes were extremely light as financial institutions in North America were shuttered. However, the price action of the USD/CAD higher also reflects what has been taking place in other major currency pairs. Traders may assume that the return of large volumes to Forex today will calm down what appears to be rather nervous conditions as the USD surges upwards. However, stepping in front of powerful trends can be extremely dangerous.

The ability of the USD/CAD to climb above the 1.36000 level this past Friday and sustain momentum upwards has brought the currency pair into values traded in the last week of May. The highs now being attained clearly put the USD/CAD within sight of a higher stretch of values traversed in March of this year. Speculators may believe the USD/CAD is too bullish and want to sell the currency pair, but they need to be extremely cautious because it has traded higher.

Economic Data from Canada and the U.S. will be Light Today, Tomorrow the BoC Lurks

- The Bank of Canada will release its Overnight Rate tomorrow, but no dramatic changes are anticipated.

- Economic data in Canada and the U.S. have been lackluster.

- Recent data from the U.S. has created the belief the U.S. Federal Reserve will have to start becoming less aggressive over the mid-term.

- This Thursday many U.S. Fed officials will be speaking at various events and their rhetoric could affect the USD/CAD significantly.

The USD/CAD range of 1.36400 up to 1.36750 needs to be monitored, if prices go above resistance in the short term it will set off more alarm bells. While traders may be tempted to look for downside price action in the USD/CAD, the move upward should be treated with respect. The near-term may produce a shift in sentiment, but nervous conditions could remain until late this week.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.36720

Current Support: 1.36570

High Target: 1.36810

Low Target: 1.36220

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform Canada to choose from.

Ready to trade our Forex daily analysis and predictions? Here's a list of the best Forex Trading platform Canada to choose from.