Top Regulated Brokers

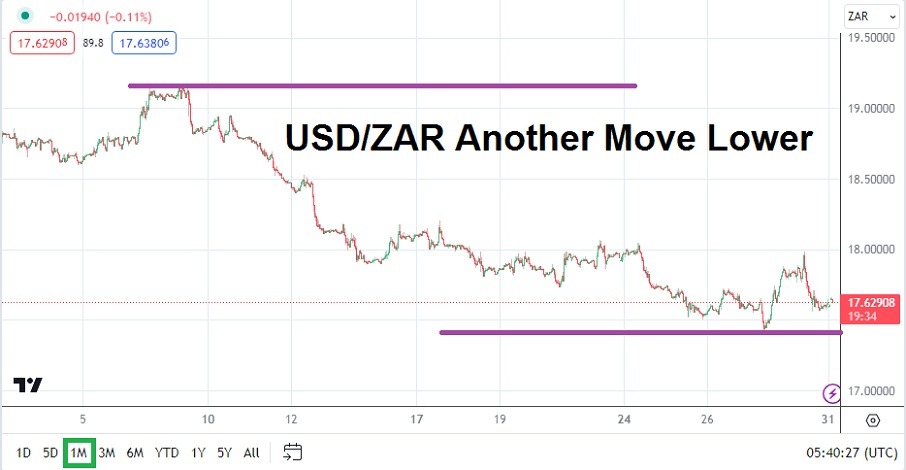

The USD/ZAR has continued to correlate to the broad Forex market in a healthy manner and as the month of August is set to begin, the currency pair is near values it last saw in February of 2023. As of this writing the USD/ZAR is near the 17.63000 ratio, but this has been delivered after a vast array of fireworks the past few days of trading. The USD/ZAR has certainly trended lower since reaching a high of nearly 19.94000 on the 1st of June, but speculators likely had a hard time convincing themselves of the downwards potential early on.

The month of August promises to be another interesting affair for the USD/ZAR. After reaching all-time highs only two months ago, the USD/ZAR has almost returned to ‘normal’ trading scenarios. Domestic political and economic issues in South African continue to make news, but for the moment a more tranquil landscape has developed. South Africa will host the BRICS conference during the last week of August and this is already beginning to make news regarding attendees and by the middle of the month will likely make international news. However, the impact of the BRICS meeting on the USD/ZAR is unlikely to be large.

USD/ZAR Correlating to U.S Federal Reserve in a Healthy Context

The USD/ZAR is traversing support levels which technical traders will find fascinating and perhaps cause nervous reactions. The USD/ZAR did trade at a low of nearly 17.43000 last Thursday as financial institutions danced in step with gyrations being caused by the U.S Federal Reserve and the belief the U.S central bank could become less aggressive over the mid-term. The USD/ZAR also jumped higher on mid-Thursday and last Friday upon the news the U.S GDP numbers were stronger than expected.

Market behavior in Forex is showing nervousness across the board and the trading of the USD/ZAR has been mirroring the results. The ability to trade lower in a bearish manner cannot be dismissed and USD/ZAR traders now have to decide what will happen next within the current lower price realms being produced.

- The 17.00000 level for the USD/ZAR was last traded on the 2nd of February, and the last time the currency pair saw sustained trading below this value was in January of this year.

- While pursuit of the downwards cycle in the USD/ZAR may feel like the right thing to do, traders should certainly not get over ambitious and remember that economic concerns in South Africa make trading the currency pair a volatile endeavor.

USD/ZAR Outlook for August 2023:

Speculative price range for USD/ZAR is 16.87000 to 18.320000

The price velocity of the USD/ZAR downwards continued to cause surprises in July and forecasting its trading action for August almost feels foolhardy. However, the trend downwards cannot be dismissed and the ability to mirror the broad Forex market must be taken seriously. If global financial institutions continue to believe we are nearing the end of interest rate hikes from the U.S Federal Reserve, the USD/ZAR may continue to be able to incrementally trade lower.

U.S inflation data needs to be watched and one of the first steps regarding this information will be this coming Friday when the U.S Non-Farm Employment Change and the Average Hourly Earnings reports will be published. If inflation via the wages data shows a slight decrease this could spur on more selling of the USD/ZAR. However, U.S data has been quite challenging the past couple of months regarding proper forecasting.

The USD/ZAR has shown the ability to create a large amount of momentum. Traders who want to pursue further price action lower cannot be blamed but solid risk management is needed, and realistic targets should be used. If the USD/ZAR manages to trade below the 17.40000 ratio in the near-term and sustain lower prices this would be rather remarkable and could signal additional lower movement is possible.

If the USD/ZAR begins to creep higher it will likely be mirroring nervous Forex result being seen in other major currencies based on fragile market sentiment. A move above the 17.80000 would cause jittery reactions if the ratio is sustained higher. The USD/ZAR has proven strong the past couple of months and it ability to trade lower has been noteworthy. It might be time for equilibrium to be produced, meaning choppy trading in the weeks ahead that tests its current price range could be seen.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.