In today's morning trading, the price of the sterling fell against the US dollar strongly, with losses that affected the support level at 1.2930. It completed profit-taking sales in the recent trading sessions, after testing the resistance level at 1.3142, its highest in 15 months. Overall, the pound fell sharply after UK inflation read at 7.9% (YoY), down from 8.7% previously, while the all-important core CPI read 6.9%, down from 7.1%.

Top Regulated Brokers

The CPI was expected to have increased by 8.2% yoy with core inflation expected to remain at 7.1% (YoY).

Also officially announced today, UK consumer price inflation rose just 0.1% month-on-month in June, the Office for National Statistics said, which was well below the 0.4% the market was looking for and down sharply from the 0.7% increase in the previous month. Core inflation rose 0.2% (MoM) in June, half the expected 0.4%, and fell sharply from 0.8% in the previous month.

This deficit prompted the markets to lower expectations for future interest rate hikes from the Bank of England, which in turn weighed on British bond yields and the pound sterling. Early responses from economists suggest that the Bank of England will raise interest rates by another 25 basis points in August, while the market consensus was for a 50 basis point hike.

The market is likely to lower this expectation according to the data, which should be reflected in lower British bond yields and a lower British pound. The pound rallied into 2023 as UK inflation proved more resilient than expected and prompted the Bank of England to take a more aggressive stance on monetary policy by raising interest rates and reversing its dovish guidance.

The general rule is that a failure to achieve inflation will lead to a weaker pound, and this is what happens. However, lower inflation will certainly boost the UK's economic outlook as households and businesses see the end of price pressure in sight. Therefore, the Bank of England will not be required to raise interest rates as aggressively as previously expected, which could lead to lower mortgage rates. So while the near-term outlook for the pound has shifted lower as expectations of a rate hike have declined, the longer-term outlook has likely improved along with the economic outlook.

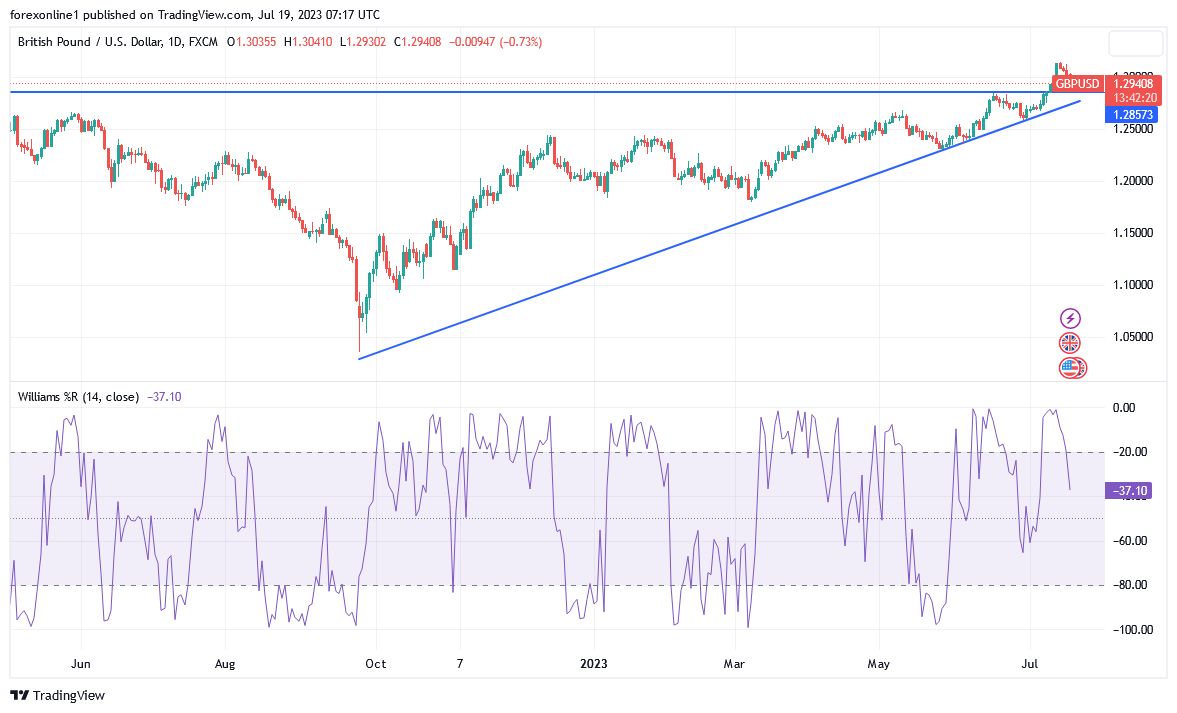

GBP/USD Technical Outlook

- The price of the GBP/USD currency pair has formed higher lows linked to a stable rising trend line since June. And the price may be ready for another test of the support, which is in line with the Fibonacci retracement levels.

- As the 38.2% level closes at 1.2993, while the 50% level closes at 1.2916.

- The bigger correction might reach 61.8% Fibonacci retracement which is in line with trend line support and area of interest at 1.2900 key psychological sign.

And if any of these hold as the floor, Cable could resume the climb to the swing high of 1.3143 or higher. Technical indicators indicate that the upward trend may continue. Whereas, the 100 SMA is above the 200 SMA to indicate that the general trend is still bullish or that the support levels are more likely to hold than to be broken. The 100 SMA lines up with the trend line adding to its strength as support.

The Stochastic is moving down now but seems to have bottomed out and is dropping into the oversold zone. A shift to the upside could mean buyers are ready to return and maintain the uptrend. And the RSI has more room to slide before reaching the oversold zone to reflect exhaustion among the sellers, so the correction may continue to occur.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading platforms UK to choose from.