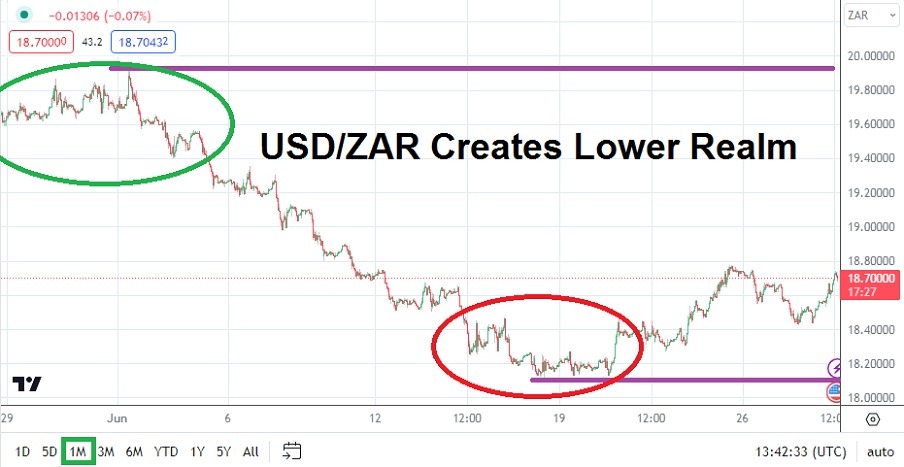

The month of June was not kind to bullish speculators of the USD/ZAR who believed the trend upwards which had been established in early May would continue. An all-time high for the USD/ZAAR was in fact hit on the 1st of June, but from that point on the currency pair started to reverse lower as the behavioral sentiment of financial institutions actually produced strong selling. A low of nearly 18.11500 was demonstrated on the 16th of June in the USD/ZAR, then met with slight reversals higher and then followed by challenges to lower depths again until the 20th.

Top Regulated Brokers

The USD/ZAR began a correlated trading result with the broad Forex markets from the start of June and it has lasted until now – this as we get ready to start the month of July. As of this writing the USD/ZAR is around the 18.70700 ratio with fast conditions flourishing as behavioral sentiment in global markets are exhibiting signs of nervousness based on discomfort regarding what the U.S Federal Reserve is going to do next.

Putting Aside South African Politics and Focusing on Strong U.S Economic Data

The past month of trading in the USD/ZAR highlights the need to acknowledge that domestic politics within South Africa are important, but influence from the outside still remains a huge factor within the currency pair. The ability of the USD/ZAR to trade at nearly 19.92250 at the start of June and creating apex values, soon to be followed by strong price velocity lower until its depths seen almost two weeks ago mirrored widespread Forex conditions. Sentiment regarding the ‘pause’ from the U.S Federal Reserve regarding its interest rate policy on the 14th of June was priced into the USD/ZAR beforehand, and it effectively crashed through the 19.00000 level on the 8th of June and has sustained values below.

However U.S Federal Reserve power dynamics have not gone away. And it could be said that the move higher since the 20th of June in the USD/ZAR actually is a signal that financial institutions are starting to take the Fed’s FOMC Statement seriously, and that a July hike to the Federal Funds Rate may take place. Recent economic data from the U.S has come in stronger than expected and this has certainly created some upwards momentum in the past couple of days, as July begins to come into sight and speculators likely wonder about the durability of resistance above and if the climb higher will be halted or if it will continue.

- Inflation remains problematic in the U.S regarding data, but what is also troubling the Federal Reserve is the confidence levels of American consumers who continue to spend.

- Coming U.S economic data needs to be monitored by USD/ZAR traders for signals regarding coming Fed policy regarding interest rates in July.

- If U.S Consumer Sentiment figures remain strong and inflation still shows that it is stubborn in the coming weeks, the Federal Reserve is not going to look favorably on this development.

- Meaning another hike of 0.25% could be added to the Federal Funds Rate in July.

USD/ZAR Outlook for July 2023:

Speculative price range for USD/ZAR is 17.88000 to 19.35000

To put it bluntly the forecast for June price action was proven to be wrong. Speculators who are trying to pursue the USD/ZAR should feel a sigh of relief given the ability of the currency pair to correlate to the broad Forex market the past month, this is a victory for the South African Rand and hopefully one that will continue.

The USD has become rather problematic the last couple of weeks because financial institutions are starting to believe the Fed may increase its interest rate and stay moderately aggressive throughout the remainder of the year. Unless U.S economic data can start to show recessionary tendencies, the U.S Federal Reserve may have to remain hawkish sounding. But if the USD/ZAR is able to begin July’s trading below the 18.50000 ratio in a sustained manner this may be a bearish signal for speculators.

However, important economic numbers will continue to come in the weeks ahead, and if inflation remains stubborn in the U.S this could create durable support levels. Traders should not be overly ambitious regarding their outlooks for the USD/ZAR and use strict management. The lofty price of the USD/ZAR gives it the ability to still create strong and dangerous price velocity. A sudden strong move higher in the USD/ZAR may seem farfetched, but the trading results of the currency pair the past few months should serve as a warning sign to be careful.

Ready to trade our Forex forecast for the coming month? We’ve shortlisted the best Forex trading brokers in the industry for you.