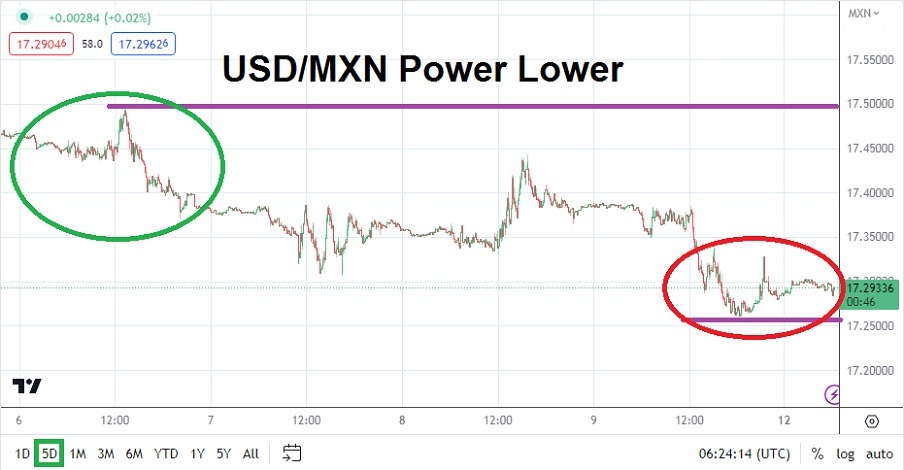

The USD/MXN is traversing values it has not traded since May of 2016, as the currency pair has extended bearish momentum and continues to prove support vulnerable.

Top Regulated Brokers

The USD/MXN broke through critical support early last week and has incrementally continued to prove the bearish trend of the currency pair remains strong. As of trading this morning the USD/MXN is battling below the 17.30000 ratio and is now traversing values it has not traded since May of 2016. Technical traders looking for lower values to consider must consider long-term charts to gain a perspective on potential new stomping grounds for the USD/MXN.

The USD/MXN has produced a bearish trend that has been steady and its ability to sustain the lower momentum quite remarkable. At this time last year the USD/MXN was trading above the 20.00000 level, but since reaching a high of nearly 25.80000 in April of 2020 during the height of the coronavirus fears the currency pair has progressively traded with selling frequently dominating. However, the move lower has also been interrupted by definite reversals higher which day traders certainly have had to battle.

USD/MXN Lower Trend is Not a Guaranteed Profit for Speculators

Traders need to understand that quick-hitting wagers on the direction of the USD/MXN offer no guarantees of success. The use of leverage and allowable timeframes while being hit by fees can make trying to pursue the lower momentum of the USD/MXN very difficult. The currency pair is trading with a healthy bearish trend, but the USD/MXN still needs solid risk management to take advantage.

The value of the USD/MXN which is now rather close to the 17.29200 mark is producing rather tight price action this morning. Traders should not be overly ambitious regarding wagers of lower depths. Take profit targets should be used that look for solid results, but do not have unrealistic expectations.

USD/MXN Volatility is Likely because of U.S Inflation data and the Federal Reserve

- CPI data will come from the U.S. tomorrow, if the inflation number is weaker than anticipated this could help the USD/MXN build additional selling momentum.

- The U.S. Federal Reserve will announce its Federal Funds Rate on Wednesday.

- It appears financial institutions may be leaning towards the belief the U.S. central bank will not raise its interest rates this Wednesday.

- But traders should be cautious before the official decision is made public.

USD/MXN Short-Term Outlook:

Current Resistance: 17.30100

Current Support: 17.28800

High Target: 17.33800

Low Target: 17.26600

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out.