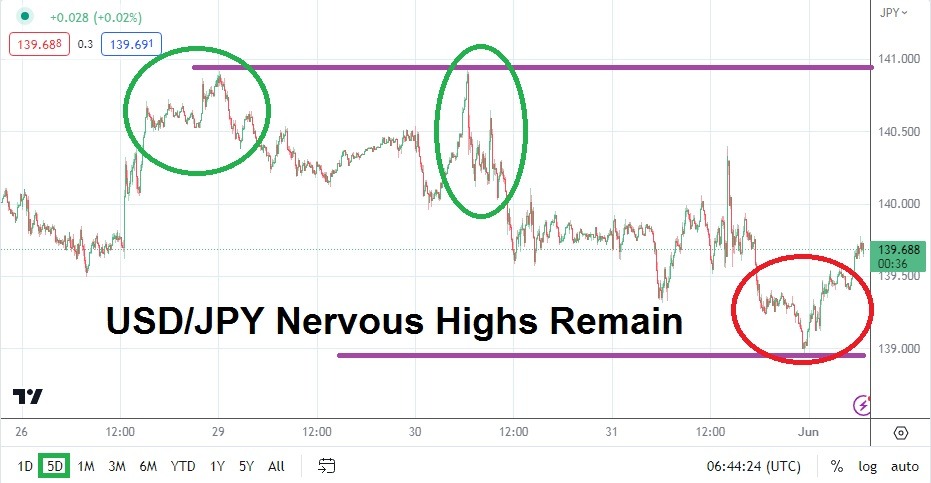

The USD/JPY is trading near the 139.800 ratios as of this writing. Trading in the currency pair has proven volatile, but the incremental march higher also continues to be exhibited. Speculators can certainly look for reversals lower, however, and yesterday provided some impetus lower after two U.S Federal Reserve officials came out and said that a June halt of interest rate increases should be considered.

But the Forex market has not been a calm landscape, and following the comments from two Fed officials yesterday, the U.S-based JOLTS jobs numbers published soon afterward came in stronger than expected. The Non-Farm Employment Change data and Average Hourly Earnings report will be published on Friday from the States. If employment results remain strong, and inflation via the wages data tomorrow shows a stubborn statistic, the Fed officials who spoke yesterday may be looked at by financial institutions as troublemakers.

Lack of Clarity from the U.S Federal Reserve will make USD/JPY Trading Conditions Choppy

Traders hoping for tranquil results in the USD/JPY should look elsewhere or perhaps simply sit on the sidelines until tomorrow’s U.S jobs numbers are published. Yesterday’s fall below the 139.000 level was certainly interesting, but the inability to sustain the lower price level may be a warning that nervous financial institutions are still leaning toward the potential of higher price action. Speculating may be dangerous in the USD/JPY in the short term for day traders.

Yesterday’s high in the USD/JPY touched the 140.400 ratio and traders should understand the price movement in the currency pair has been very fast, which is another sign that the lack of clarity from the U.S. Federal Reserve is causing havoc. New highs are showing up consistently for the USD/JPY. The trend higher in the USD/JPY since late March is noteworthy and may have caused a lot of problems for speculators who had gotten used to the downward momentum in the USD/JPY earlier in 2023 when the currency pair traded near the 127.100 ratios in the middle of January.

USD/JPY Short and Near-Term Trading Needs Solid Risk Management

- Early Monday and yesterday’s trading in the USD/JPY produced technical highs for the month of May.

- The higher realms of the current price range are now challenging values last seen in November of 2022.

- While financial houses seemingly bet on the Federal Reserve becoming more dovish early this year, the recent aggressive rhetoric from the U.S. Fed has changed the long-term outlook and this has certainly caused volatility for short-term speculators.

USD/JPY Short-Term Outlook:

Current Resistance: 139.950

Current Support: 139.520

High Target: 140.510

Low Target: 139.220

Ready to trade our daily Forex forecast? Here’s a list of some of the best online forex trading platforms to check out.