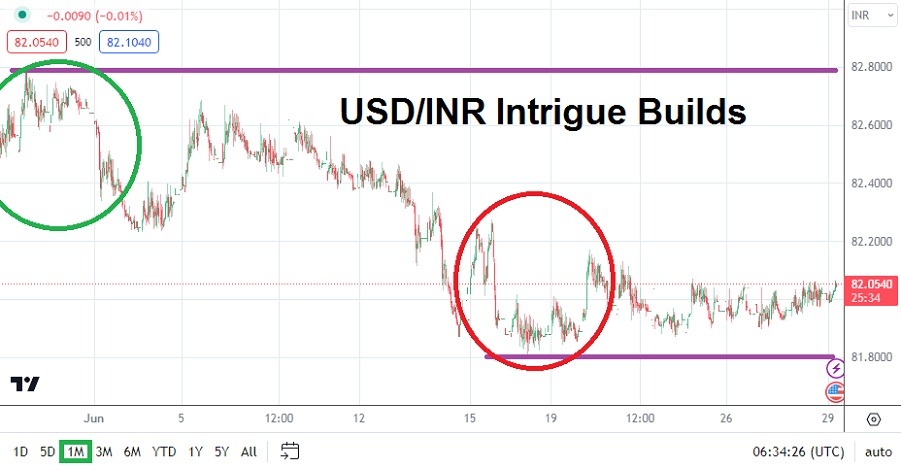

The USD/INR was trading near the 82.7900 ratio at the end of May, but during the month of June the currency pair certainly exhibited ability to trade lower and wave seemingly goodbye to its record high values. The USD/INR has traded in a correlated fashion with the broad Forex market, which should make speculators feel more optimistic about pursuing its technical momentum in the weeks ahead.

Top Regulated Brokers

The USD/INR traded near a low around the 81.7950 mark on the 15th of June, which directly corresponds to the fact the U.S Federal Reserve confirmed it would not increase its Federal Funds Rate on the 14th. Trading from the 5th of June until the Fed’s FOMC Statement clearly anticipated the pause of interest rate hikes, which was made official on the 14th. However, since reaching this low water mark the USD/INR has found rather consolidated trading and a slight incremental climb develop. But this too, corresponds to the broad Forex market as financial institutions are seemingly bracing for the potential of an increase in the Federal Funds Rate from the U.S Fed in late July.

The 82.0000 Ratio has become a Focal Point in the USD/INR the Past Ten Days

Trading in the USD/INR has taken on a cautious tone the past ten days as a range largely between the 81.9000 to the 82.0500 has been seen with occasional outliers. The ability of the USD/INR to drift slightly upwards has mirrored the results in the broad Forex markets, as U.S economic date has provided stronger than expected Consumer Confidence readings and also shown that inflation remains problematic. The combination of solid spending from U.S consumers when higher prices have to be paid for services and goods has certainly put the Federal Reserve in a rather hawkish mode.

- Inflation data which will come in July should be monitored and if it remains stubborn, the U.S Fed will be put into a position in which they not only rattle their hawkish interest rate rhetoric, but have to act also with another 0.25% rate increase.

- The ability of the USD/INR to incrementally challenge higher prices the past ten days is a signal that financial institutions are bracing for another hike from the Fed. In the coming weeks, this could create durable support for the USD/INR.

The 82.1000 Ratio Above needs to be monitored by USD/INR Traders

If financial institutions begin to fully accept the notion the U.S Federal Reserve will increase interest rates in late July, the USD/INR could incrementally continue to nudge higher. Because it appears seemingly unlikely the Reserve Bank of India will increase its own key borrowing rates in the near-term, this may cause the USD/INR to test higher values. If the 82.1000 level is broken higher and sustained, this could prove an ignition switch for additional nervous buying in the July.

USD/INR Outlook for July 2023

Speculative price range for USD/INR is 81.6500 to 82.4500

Having dealt with a hawkish Federal Reserve for over a year the USD/INR has reacted with a rather steady incremental rise of values which has demonstrated a solid trend. However the Reserve Bank of India has also shown the ability to intervene time to time in the USD/INR and not allow the USD to grow too strong.

The past four weeks of trading certainly saw the USD/INR exhibit a strong downturn and the selling marched in step with other major currency pairs. Last month’s trading proved behavioral sentiment in financial institutions correctly predicted the Fed would pause in June, but now nervous conditions are being seen which leads to the belief another hike from the U.S will come late in July.

The question is how much of a hike has been priced into the USD/INR already, if the Fed does pursue a more aggressive stance in late July. A more aggressive stance from the U.S Federal Reserve is likely to cause support ratios to provide speculators a potential opportunity to buy the USD/INR if it tests the 81.9000 to 81.8500 ratios below in the coming weeks.

If the Fed doesn’t raise interest rates this could send the USD/INR back to the 81.7500 to 81.5000 levels. However a hike could bring the USD/INR up to the 82.2000 to 82.3000 ratios. Depending on the amount of rhetoric that develops from the U.S central bank over the next handful of weeks traders should anticipate the potential of additional surprises.

Ready to trade our Forex monthly forecast? Here’s a list of some of the best Forex trading platforms to check out.