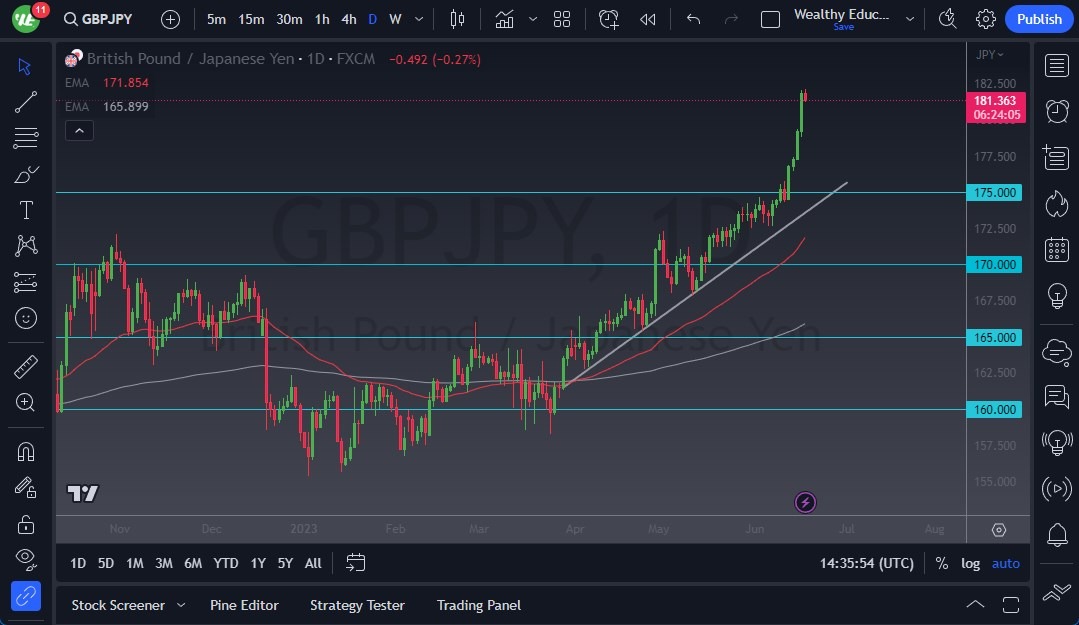

During Monday's trading session, the GBP/JPY displayed a back-and-forth movement, indicating uncertainty as market participants assess the potential return of gravity to the picture. After experiencing a relentless upward trajectory throughout the previous week, a loss of momentum is not unexpected, particularly considering the impressive gain of over 700 pips.

Top Regulated Brokers

In this context, the ¥180 level holds the potential for support, given its significance as a large, round, psychologically important figure. Furthermore, it is likely that this level is accompanied by options barriers, further reinforcing its importance. However, should the market break below ¥180, a drop toward the ¥175 level, previously acting as resistance, becomes plausible. If such a scenario unfolds, the market could potentially regain its bullish momentum as it offers attractive value to buyers.

All factors considered it appears that adopting a "buy on the dips" approach remains appropriate for this market. Nevertheless, following the explosive surge witnessed in the past week, it is prudent to wait for a significant pullback before initiating buying positions. The market's exuberant ascent raises the possibility of consecutive negative days. Thus, patiently awaiting signals on the daily chart, indicating a resurgence of buying interest, would provide more favorable entry opportunities.

Be Cautious

- Alternatively, if the market breaks above the high of Monday's candlestick, it could target the ¥182.50 level. However, chasing the market at its current state does not seem prudent.

- The recent rapid ascent suggests an overbought condition, and markets that spike sharply often offer opportunities to buy at more favorable prices during subsequent dips.

- Consequently, exercising caution and waiting for suitable market conditions would be a prudent approach. Given the current runaway nature of this market, making profits will likely require considerable patience.

Ultimately, as the British pound engages in a back-and-forth movement, traders closely monitor the potential return of gravity's influence on price action. The exceptional surge observed last week has prompted a period of consolidation, highlighting the need for a pullback to restore balance. Key levels of support and resistance, such as ¥180 and ¥175, respectively, hold significance in shaping future market direction. The "buy on the dips" strategy remains viable, but waiting for clear signals on the daily chart is recommended to gauge renewed buying interest. Alternatively, a breakout above Monday's candlestick high could lead to further upside potential. However, exercising caution and refraining from chasing the market's current overextended state is advised. Successful navigation of this runaway market requires patience and astute timing to seize favorable entry points during subsequent dips.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK in the industry for you.