The difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which direction, and not on the exact methods you might use to determine trade entries and exits.

So, when starting the week, it is a good idea to look at the big picture of what is developing in the market as a whole, and how such developments and affected by macro fundamentals, technical factors, and market sentiment. There are just a few valid long-term trends in the market right now, which might be exploited profitably. Read on to get my weekly analysis below.

Fundamental Analysis & Market Sentiment

I wrote in my previous piece on 7th May that the best trade opportunities for the week were likely to be:

- Long of the EUR/USD currency pair following a bullish reversal on the H4 time frame rejecting $1.0920. This did not set up.

- Long of the NASDAQ 100 Index. The Index ended the week 0.50% higher.

- Long of the GBP/USD currency pair. The currency pair ended the week lower by 1.45%

My forecast produced an overall loss of 0.95%, averaging a loss of 0.32%.

Markets are currently dominated the slightly lower than expected US inflation data which was released last Wednesday, showing the annualized rate had fallen slightly from 5.0% to 4.9% when it had been anticipated to hold steady. Although this headline seemed like good economic news, the core CPI was actually higher than expected, meaning this inflation data was not really so rosy. Despite that, stock markets rallied, and the US Dollar sold off after the release of this data. However, by the next day, as markets digested that the news was not so positive, the US Dollar rallied strongly, as sentiment began to catch up with the Fed’s hints that the end of the current rate tightening cycle has not quite been reached finally began to filter through.

There was some potentially positive data concerning US inflation later in the week, with US PPI coming below expectations. The other major event last week in the Forex market was the Bank of England’s rate hike of 0.25% to an Official Rate of 4.50%, but this was widely expected in the market.

Markets will now be focused on the coming release of US retail sales data and Canadian CPI (inflation) data this coming week.

Last week’s other key data releases were:

- US Unemployment Claims data – this came in slightly higher than expected.

- UK GDP data – this came in worse than expected, showing a month on month decline of 0.3% when no change was expected. This is not positive news for the British Pound.

- US Preliminary UoM Consumer Sentiment – this came in considerably worse than expected, suggesting the US economy may be slowing down.

- New Zealand Inflation Expectations data – this showed a meaningful drop from last month’s data, suggesting inflationary expectations are falling.

The Week Ahead: 15th – 19th May

The coming week in the markets is likely to see a lower level of volatility than last week, as the scheduled high-impact releases this week are unlikely to have as much effect as last week’s release of US CPI data. This week’s key data releases are, in order of importance:

- US Retail Sales data

- US Unemployment data

- Canadian CPI (inflation) data

- US Empire State Manufacturing Index data

- UK Claimant Count Change

- Australian Wage Price Index data

- Australian Unemployment data

Thursday will be a public holiday in Germany, France, and Switzerland.

Technical Analysis

US Dollar Index

The weekly price chart below shows the U.S. Dollar Index rose strongly last week against its long-term bearish trend, seeing one if its biggest weekly rises since September 2022.

The weekly candlestick is a bullish engulfing bar which closed right on its high price, which is another bullish sign. This candlestick can signify trend reversal. If you drill down to the daily chart, you can see the bullish double bottom chart formation rejecting the area at 101.00 which reinforces the bullish case.

Despite these bullish signs, it is true that the greenback remains within a valid long-term bearish trend, with its price lower than it was both 3 and 6 months ago. The price also ended last week not far from a key resistance level at 102.80. which could halt any further large rise over the short term.

I would be nervous to trade against the US Dollar over the coming week unless there is a very strong bearish reversal later at 102.80.

NASDAQ 100 Index

We saw another small rise in the NASDAQ 100 Index over the past week. The picture here is weakly bullish, for several reasons:

- The weekly candle closed higher, but is not far from being a doji candlestick, which can signify directional indecision.

- The weekly candlestick closed in the middle of its range.

- The lower wick of the weekly candlestick rejected the round number at 13200.

- The weekly candlestick again made its highest weekly close and high prices since August 2022, showing we have a bullish breakout situation, as well as a valid long-term bullish trend.

There are no key resistance levels until 13730, so the price has room to rise.

The NASDAQ 100 Index still looks like a buy.

EUR/USD

EUR/USD

The EUR/USD currency pair printed a bearish engulfing candlestick, with a relatively large range, which closed right on the low of its price range. This was the biggest weekly fall we have seen in this currency pair since September 2022.

The week ended with a strong recovery by the US Dollar, which calls into question the long-term bullish trend in this currency pair. If we get a daily close now below $1.0790, we will have seen a bearish retracement of more than three times the long-term daily average true range, which will strongly suggest that the bullish trend is over.

Despite these bearish signs, and my unwillingness to trade against the US Dollar over the coming week, there is still a meaningful chance that this is just a deep retracement against the trend – this currency pair likes to make deep retracements.

Traders willing to take a trade with a potentially large reward to risk ratio might look to buy any bounces at key support levels here over the coming week, at least until there is a daily close below $1.0790.

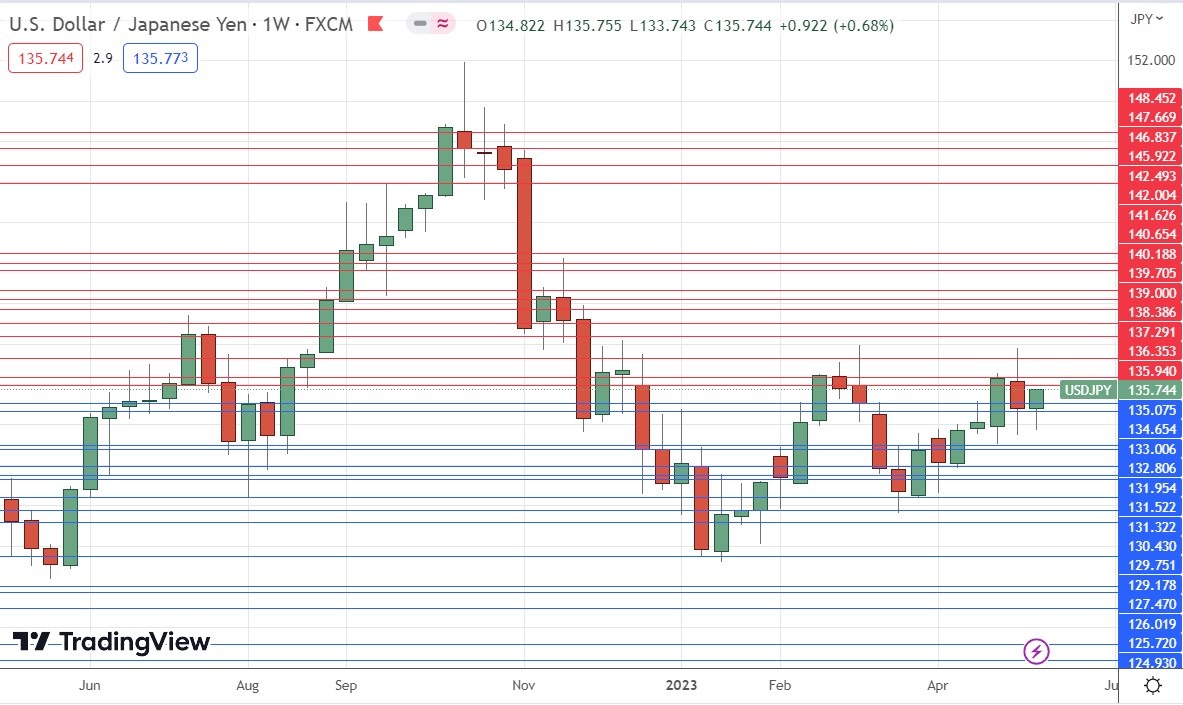

USD/JPY

The USD/JPY currency pair rose last week, printing a bullish piercing candlestick which closed right on the high of its range.

What is notable here is that the price seems to be rising again to test the area where we have a long-term bearish double top, with the area at about ¥137.35 / ¥137.50 likely to act as a very pivotal point. If the price can get established above there, it could go on to make a much more significant bullish move.

I think that it will be unwise to trade against the US Dollar over the coming week, despite the Dollar’s still-valid bullish trend, because we are seeing a strong bullish reversal in the US Dollar. That could make this currency pair attractive to day trade long.

Gold

The price of Gold in USD terms fell very slightly over the past week but closed above $2000 an ounce not far from its highest weekly close since August 2020. This came after the price came very close to equaling its all-time high at about $2,070 the week before last.

We see a weekly candlestick in the price chart below which is both an inside bar and a doji. These factors could make bulls cautious, as they signify indecision and therefore a potential trend reversal, but bulls can point to the relatively high weekly close above the big round number and the persistent long-term bullish trend, as well as the fact that in a very strong week for the USD, Gold held its value in USD terms very well, suggesting that strength remains in Gold.

It is also worth remembering that although it tends to be seen as a hedge, the price of Gold is historically strongly positively correlated with the US stock market. So, as we see stocks rising again, we see Gold rising too, which arguably makes this move more solid.

I remain weakly bullish on Gold, seeing the best opportunities as trading any reversals off recent daily lows on shorter time frames such as H4 or even H1.

WTI Crude Oil

The price of WTI Crude Oil fell over the past week for the fourth consecutive week and closed right on the low of its range.

The price chart below shows that WTI is well established within a long-term bearish trend and the linear regression analysis drawn over recent price action show this to be a very well-defined and symmetrical trend, suggesting it can be an interesting trend to trade short.

It is not clear that fundamental factors are in place to affect either demand or supply sufficiently to justify believing that this trend has much further to run, but the persistence of this trend should be respected.

Trading well-defined breakouts to long-term highs or lows has been a profitable strategy for trading WTI in the past, so I will enter a new short trade here if we get a daily close below $65.

CANE

The Sugar ETF CANE has seen a more than 40% price rise since the start of 2023. After initially making quite a deep bearish retracement two weeks ago, it bounced back to reclaim its eye-watering bullish momentum, with the highest daily close for many years made near $14.00.

However, the past week has seen a slight fall, with the printing of a candlestick which is something between a doji and a pin bar. This is weakly suggestive of higher prices, despite the very high relative volatility which tends to suggest lower prices.

It is always difficult to forecast where such strong trends might reverse, but bulls should be aware the price has gone up by a lot and the trend could be seen to be very over-extended. I would therefore prefer to wait for a consolidation and subsequent bullish breakout before entering a new long trade here.

There may be likely resistance levels at $14.25 and at $15.00.

It has historically been very worthwhile trading new 6-month high breakouts in commodities, using a volatility-based trailing stop.

Bottom Line

I see the best trading opportunities this week as:

- Long of the NASDAQ 100 Index.

- Day trading the USD/JPY currency pair on the long side.

- Buying Gold if it bounces convincingly at key support levels like $1949 or $1918.

- Going short of WTI Crude Oil if we get a daily close below $65.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.

EUR/USD

EUR/USD