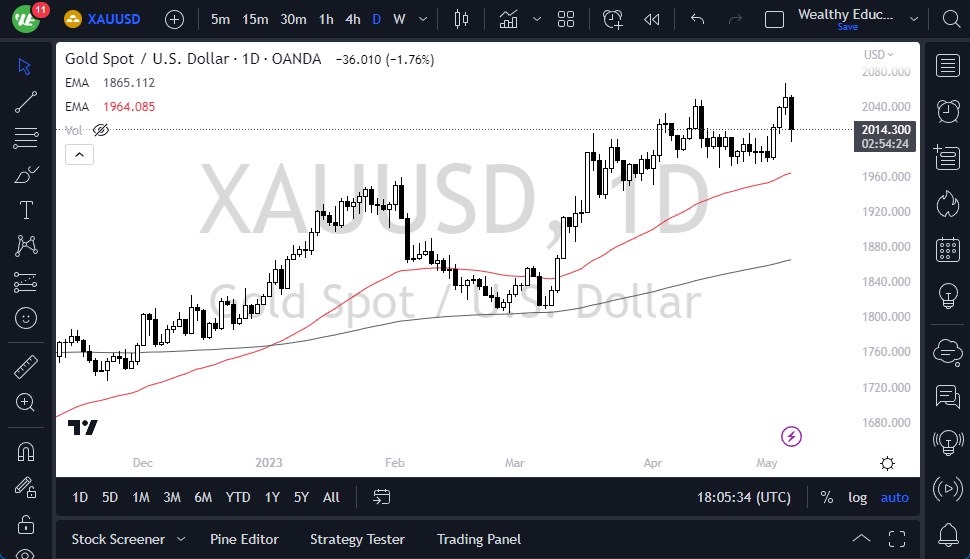

- The gold market experienced a sharp decline on Friday following a period of exhaustion on Thursday. Despite this setback, the market has since tested the previous consolidation area, where buyers have begun to re-enter the market.

- Given the strong trend in the market for an extended period, it is highly likely that buyers will continue to push gold higher.

- Furthermore, the sudden fall on Friday may have effectively shaken out the weak hands, which may ultimately prove to be a positive factor for the market.

Looking ahead, the 50-Day EMA which is just below the previous consolidation area is likely to serve as a dynamic floor in the market, further bolstering investor confidence. Additionally, given the various concerns around the world when it comes to wealth preservation, gold has historically been considered a go-to asset in these times, which could potentially drive further demand in the market.

While the market is likely to continue to be volatile and challenging, it is not the right time to sell. Most of the bearish pressure likely resulted from the forced liquidation of larger funds that needed to raise capital to cover other positions. Thus, rather than giving in to this pressure, investors may find it more beneficial to approach the market from a long-term perspective and capitalize on any potential buying opportunities that arise.

Volatility Ahead

It is worth noting that the sudden plunge in gold prices represents an excellent buying opportunity for those looking to enter the market. Buyers have already started returning to the market, and this trend is likely to continue. Additionally, it will be interesting to see how the weekend plays out with the regional banks in the United States, many of which are in trouble. Traders may look to gold as a haven, using the massive drop during the day as a potential value and entry point into a market that has been sustainably bullish for several months.

Ultimately, while the gold market may have experienced a sharp decline on Friday, the previous consolidation area has acted as a key support level, allowing buyers to re-enter the market. Given the global concerns around wealth preservation, gold is likely to remain an attractive asset for many investors, further boosting demand. While the market may continue to be volatile, long-term investors should consider potential buying opportunities that arise, and avoid giving in to bearish pressure.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out.