Top Regulated Brokers

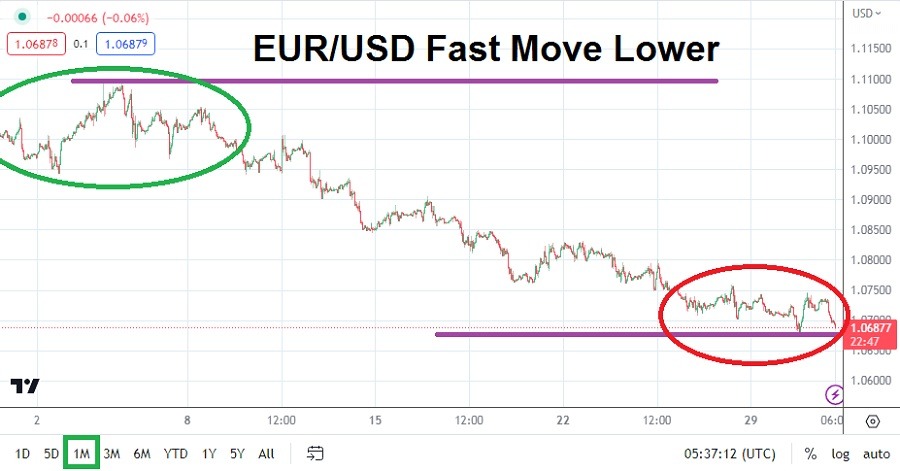

The EUR/USD provided traders lucky enough to be pursuing momentum downwards plenty of reasons to cheer. For those caught on the wrong side of the downwards slide, the EUR/USD however was more likely to be a nightmare. The moves lower in the EUR/USD during the month of May technically looks like a six month chart. The price velocity of the EUR/USD the past three weeks of trading has been fast and violent.

Support levels have proven vulnerable for the EUR/USD and as the month of June gets prepared to start, speculators should get ready for the potential of more trading dangers. While technical traders may try to explain the downwards price action of the EUR/USD based on graphical analysis and fancy lines and occasional triangles showing why the price of the currency pair moved so swiftly, there happens to be a fundamental reason why the EUR/USD has reacted with volatility lower.

Financial institutions have been caught off guard by the aggressive rhetoric from the U.S Federal Reserve and its confirmation via the FOMC Meeting Minutes published last week. It appears interest rate hikes in the U.S will continue to creep up until the U.S central bank feels it has stopped inflation. Data from the U.S shows inflation remains stubborn and this sets up a difficult path for traders, financial institutions and global central banks. The EUR/USD started the month of May within sight of the 1.11000 ratio; it is starting June closer to the 1.07000 level.

EUR/USD Lows are being tested and Next Two Weeks may Prove Unfriendly for Wagers

Traders who refused to believe the EUR/USD could drop below the 1.09000, 1.08000 and now the 1.07000 ratio the past few weeks have likely found their wagers turning out to be costly losses if risk management has not been used properly. The ability of the EUR/USD to break below 1.07000 briefly yesterday was another signal that financial institutions have been surprised, and are likely repositioning for more gyrations which will be caused by U.S Federal Reserve antics. The current price of the EUR/USD appears to have factored in the potential for a couple of more interest rate hikes from the U.S central bank.

Speculators who believe the EUR/USD is oversold and feel like now is the time to start looking for upside cannot be blamed, but they may be proven wrong too. The rapid move lower in the EUR/USD has been extremely fast and the currency pair is now within sight of values last seen on the 20th of March. Yes, the EUR/USD looks low when its prices are studied, but the currency pair has also correlated to other major Forex pairs teamed against the USD.

- The U.S Federal Reserve will make its Federal Funds Rate announcement on the 14th of June.

- It appears financial institutions seem to have factored in another increase from the U.S central bank, but it is the rhetoric which will come from its June pronouncements regarding outlook which are now creating nervousness.

EUR/USD Outlook for June 2023:

Speculative price range for EUR/USD is 1.05195 to 1.08960

Traders who want to look for more downside price action in the EUR/USD should be cautious and not overly ambitious. The move lower the past few weeks have certainly been rapid, but it might have produced a significant amount of the overall declines which could start to slow down.

Yes, traders and financial houses have been surprised already the past few weeks as support has crumbled and prices levels proved weak. Perhaps the EUR/USD could test the 1.06000 level, but a move below this would be another rather large surprise for financial institutions and traders alike. The 1.07000 value now been challenged should be watched. If the EUR/USD see sustained trading below this level it could spark lower moves and tests of the 1.06900 to 1.06700 levels.

While the EUR/USD certainly looks oversold to many, the currency pair has proven perceptions of value do not matter, only the actual market price is of importance. Looking for upside price action in the EUR/USD in the coming days and weeks may feel tempting, but extreme caution should be used until further clarity is delivered by the U.S Federal Reserve and also rhetoric from the European Central Bank is heard. If the EUR/USD starts to see buying momentum it could prove strong, but perhaps traders should try to make sure momentum is producing a solid trend that has lasted more than a couple of days.

Ready to trade our monthly Forex forecast? Here are the best Forex brokers to choose from.