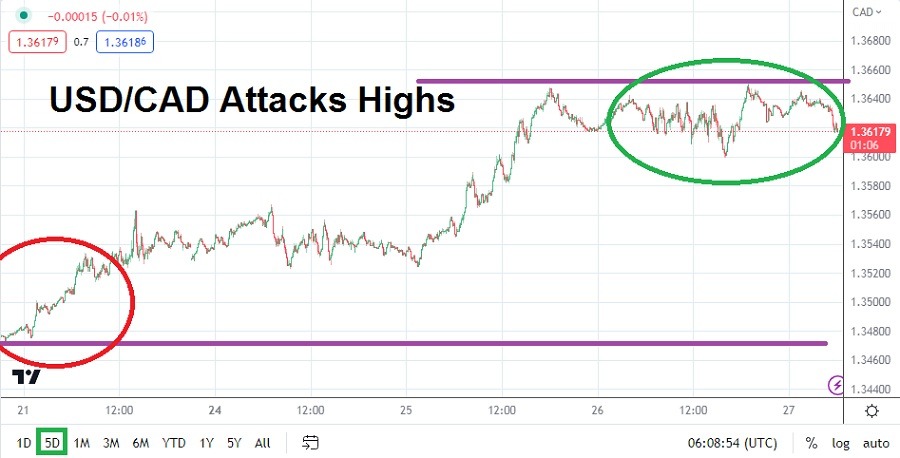

Bearish speculators of the USD/CAD who have been wagering on downside momentum to develop and remain consistent have likely been hurt the past two weeks of trading. After touching a low around the 1.33025 mark on the 14th of April, the USD/CAD has climbed higher. In price action this week, the USD/CAD started near lows within sight of 1.35275 and after bolting higher on Tuesday has held firmly onto its higher values. As of this writing the USD/CAD is near 1.36200.

USD/CAD Again within Upper Realms of Long-Term Charts

The USD/CAD is certainly not near all-time highs, but its climb from depths near the 1.32500 mark in the last week of January to its current price realms is rather telling. Since the start of February, the U.S. Federal Reserve has essentially reminded folks that inflation remains a concern. Many investment institutions who were wagering on a weaker USD to develop were taken by surprise at the Fed’s rather aggressive rhetoric and may have even been angry about interest rate hikes continuing. However, many financial houses continued to likely believe that in the mid-term the U.S. central bank would have to be less aggressive and bet against the USD.

While the USD/CAD climbed to a high of nearly 1.38600 in the first week of March as nervousness sought risk-averse positions because of the corporate banking crisis, the currency pair did reverse lower again and by the middle of April was fighting to lows again. Yet, the past couple of weeks have seen another rise and an interest rate hike from the Fed is almost certain on the 3rd of May. Traders however have seemingly been unsure about a potential hike in June also being announced. Yesterday’s improved Core Durable Orders statistics from the U.S. may be a troubling sign if traders are betting against the USD.

U.S Data Today and Tomorrow Are Important Before the Weekend

- Today Advance GDP numbers will come from the U.S., if the growth data is stronger than expected this could firmly support the USD/CAD more.

- Tomorrow inflation data will come from the U.S. and if it produces a surprise rise, this would cause volatility in the USD/CAD again and possibly ignite more buying.

While bearish traders may want to bet on lower reversals developing, caution is abundant in Forex and the USD/CAD has remained within its higher short-term price range for a reason. Financial institutions want to see today's and tomorrow’s data to gain perspectives on what the U.S Federal Reserve rhetoric maybe next week regarding its June outlook. A hike on the 3rd of May is coming, but another potential increase to the Federal Funds Rate in June has likely created USD/CAD support to grow durable and folks may believe another hike should be priced into the currency pair.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.36260

Current Support: 1.36140

High Target: 1.36590

Low Target: 1.35825

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.