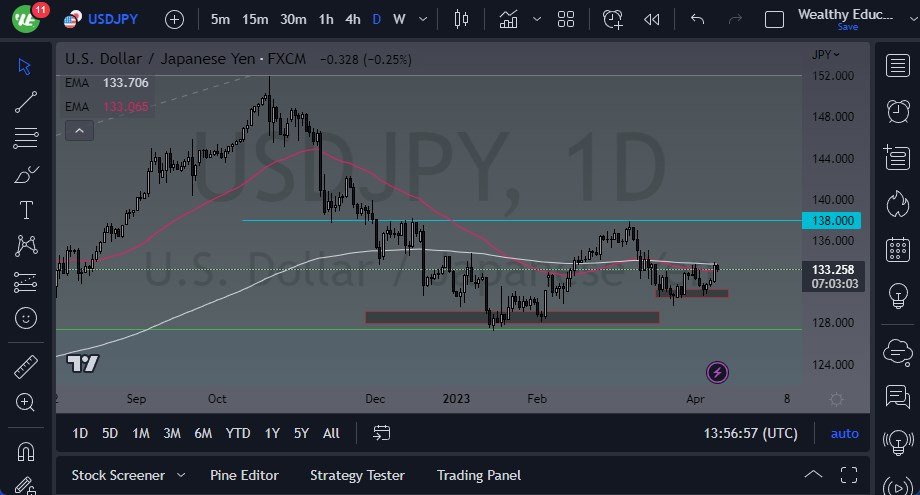

- The USD/JPY exchange rate drifted slightly lower during Tuesday's trading session, but buyers have come in beneath the 50-Day EMA, indicating signs of life.

- The 200-Day EMA is now coming into the picture, and if the US dollar can break above that critical technical indicator, it is likely to continue going higher.

- It is also possible to make an argument that another double bottom has formed at the ¥131 level, following the double bottom at the ¥127.50 level.

Yield Curve Control Policy in Focus

This suggests that the US dollar is likely to continue experiencing upward pressure, with a possible attempt to reach the ¥137.50 level. This may be especially true if interest rates continue to rise or if more money flows into the treasury market. If treasuries continue to attract a lot of inflow, it makes sense for the US dollar to strengthen, as it takes the same currency to buy those notes.

It is essential to keep in mind that the Bank of Japan is continuing its yield curve control policy, which means they are not going to let the 10-year JGB offer more than 50 basis points of interest. In order to do so, they have to print yen, which is likely to cause the Japanese currency to lose ground again. Central bank actions will continue to be a significant driver of the market's direction.

The Federal Reserve is expected to raise interest rates again during the May meeting, which should make things tighter. From everything we see, it appears that the US dollar market will eventually go higher. However, if the currency turns around and breaks down below the ¥127.50 level, it could start to fall apart. In that situation, we could see a significant amount of momentum entering the markets.

In Summary

The US dollar is experiencing some upward pressure, with buyers coming in beneath the 50-Day exponential moving average and a possible double bottom forming at the ¥131 level. If the US dollar can break above the 200-Day EMA, it is likely to continue going higher. It is important to keep an eye on central bank actions, as they will continue to influence the market's direction. The Federal Reserve's expected interest rate hike in May could make things tighter, pushing the US dollar higher. Nonetheless, if the US dollar breaks down below the ¥127.50 level, it could fall apart, indicating a possible reversal.

Ready to trade our daily Forex forecast? Here’s a list of some of the best forex trading platforms to check out.