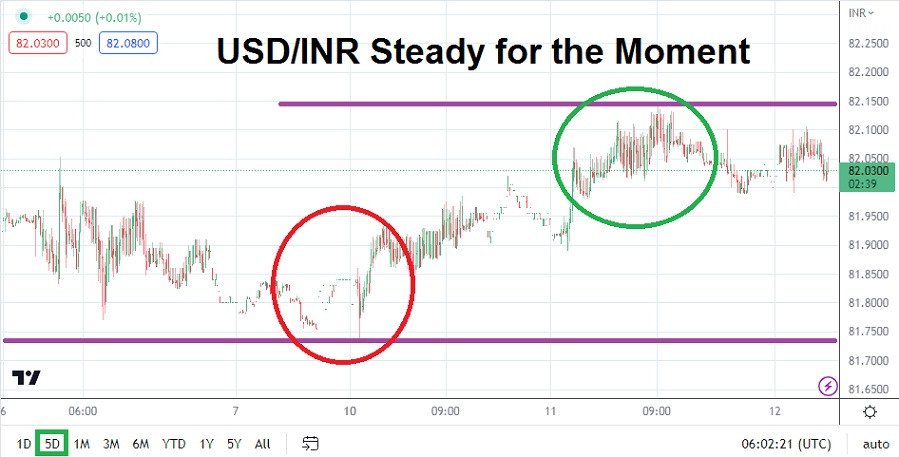

Traders who crave the potential to interact in Forex markets that are likely to produce fireworks have an opportunity experience the joys and dangers of speculating today. The USD/INR currency pair has been rather calm the past twenty-four hours and been mostly within a range of 81.9800 and 82.1350 with some brief outliers being demonstrated. As this article is being read speculators should look at the USD/INR to see where it is at this moment to gauge the state of nervous energy that is within the currency pair, because the tight range is certain to vanish abruptly.

The U.S will be releasing its Consumer Produce Index numbers today and the results will have an immediate effect on the USD/INR. This isn’t meant to scare speculators, but risk management will be essential if pursuit of the USD/INR in the coming hours is your chosen wager. The outcome of the inflation numbers in the U.S is sure to make financial houses shift their cash positions.

USD/INR Traders Should be ready for a Show

While most financial houses have already factored in another interest rate hike from the U.S Federal Reserve in early May, the great unknown is if the U.S central bank will have the ability to hike its Federal Funds Rate again in June. If today’s inflation numbers are stronger than anticipated it will cause a shiver in the global markets for a few reasons.

- The USD has essentially gotten weaker against many major currencies over the past couple of weeks including the Indian Rupee.

- This because many financial houses have held to the notion the U.S Federal cannot remain aggressive regarding its interest rate over the mid-term.

- However, if the U.S Fed believes the corporate banking sector is strong enough to handle another interest rate hike and if inflation numbers remain stubborn, the U.S central bank may stay aggressive longer than planned for by many financial institutions.

U.S Federal Reserve is playing with Fire and it is Dangerous for the USD/INR

The USD/INR will react to the U.S CPI data today. The U.S Federal Reserve has put itself in a tough and almost impossible position. If inflation remains strong via the Consumer Price Index data today, they will face a very difficult choice in the coming two months. Financial institutions have already wagered on a May increase. A rate hike in June is not wanted by nearly anyone in the corporate banking sector.

If inflation numbers meet expectations today or are lower, this could trigger USD/INR selling and calms. If the CPI numbers are significantly stronger today, than the USD/INR is likely to retest values seen in the middle of March and traders will need to have their positions protected with solid risk taking tactics, because trading will become violent. It is almost certain that today’s trading range will expand greatly before the U.S data is announced, and the following couple of hours after the release will prove volatile as the numbers are digested.

USD/INR Short Term Outlook:

Current Resistance: 82.1140

Current Support: 81.9710

High Target: 82.3710

Low Target: 81.7200

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.