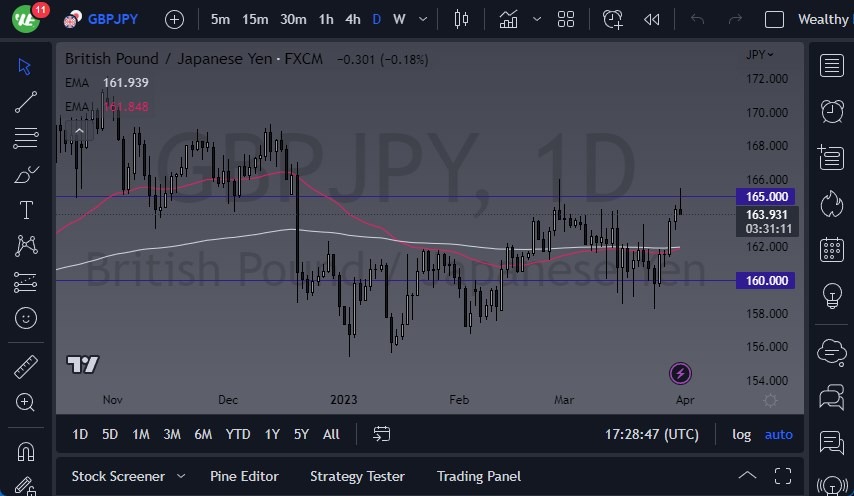

- The GBP/JPY rallied significantly during Friday's trading session, reaching above the 1.65 level before pulling back slightly.

- However, the market is likely to continue to see a lot of noisy behavior soon, as the Bank of Japan's yield curve control policy is tested at times.

- The policy of keeping the 10-year yield at 50 basis points or fewer means that the Bank of Japan would have to print the Japanese yen to keep interest rates down.

Despite the recent rally, it is worth noting that the market has given back quite a bit of momentum, which suggests that we could see some type of pullback in the short term. If this does happen, the market is likely to go looking back toward the moving averages, specifically the 50-Day EMA, and possibly even the 200-Day EMA, which sit around the same area. The market has been in a range for a while, so it will be interesting to see how this plays out.

Breaking above the ¥166.50 level could signal that the market is going much higher, potentially even higher than that. However, it is important to keep in mind that this pair is highly sensitive to the risk appetite of the markets in general. Additionally, the yield curve control policy coming out of Tokyo has a major influence on the Japanese yen. If interest rates rise, the Japanese will have to print more yen to buy those bonds. If rates drop, the market is likely to see a lot of volatility, and the Japanese yen may strengthen.

Noise Ahead

Overall, the market is likely to continue to see a lot of noisy behavior in the coming weeks. While the recent move to the upside has been significant, the analysis of the market suggests that it may be overbought. As such, a pullback could be coming in the short term. If the market does break out to the upside, it could lead to the Japanese yen losing strength against multiple currencies, not just the British pound.

Traders and investors should remain cautious and keep an eye on key support and resistance levels. The Bank of Japan's yield curve control policy is likely to continue to influence market volatility, so it is important to stay up to date with any developments in this area. Overall, while the British pound may face some noisy behavior soon, there could still be opportunities for traders and investors to profit from the market's movements.

Ready to trade our daily Forex forecast? Here’s a list of some of the best currency trading platforms to check out.