Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

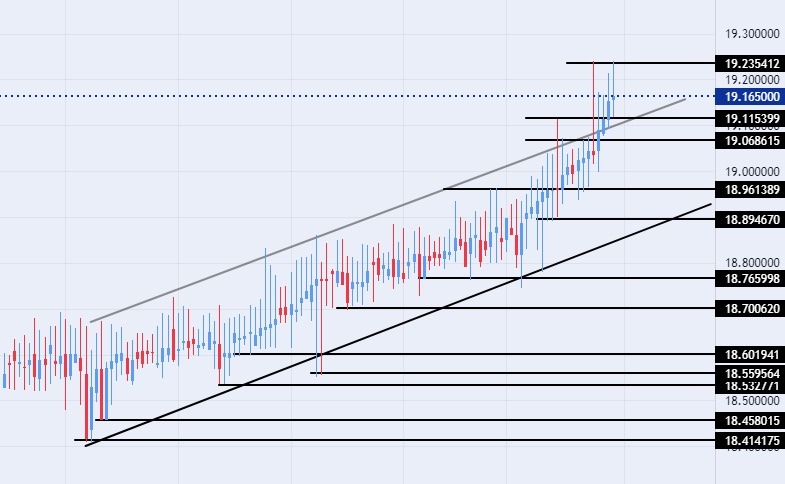

- Entering a buy order pending order from the 19.00 level.

- Place a stop loss point to close below the 18.85 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The price of the TRY/USD varied during early trading this morning, as the dollar pair settled against the lira near its all-time high, which the pair had previously recorded earlier this month. Investors followed a poll published by Reuters, which revealed expectations of a decline in the annual inflation rate during the month of March in the country, reaching 51.3 percent. The poll also indicated that inflation would reach 46.5 levels by the end of the year. Commodity prices recorded strong increases over the past year with the decline in the price of the lira, as inflation recorded record levels during the month of November, reaching its highest level in about 24 years.

The annual inflation rate in Turkey recorded a decline for the fourth consecutive month last February, although it was lower than expected, as it recorded 55.18%. Analysts attributed the rise in inflation in the country to the rise in energy imports, which jumped after the Russian invasion of Ukraine, in addition to rises in the food and non-alcoholic beverage sector. Meanwhile, Turkish President Recep Tayyip Erdogan revealed that his government will offer discounts on natural gas prices for commodity users in industries by 20% and electricity by 15%, starting next April.

USD/TRY Technical Analysis

On the technical front, the USD/TRY varied slightly during today's early trading, the pair settled near its all-time high, recording 19.23, as it traded at 19.16 levels at the time of writing. The pair retested the levels of the upper border of the bullish channel on the time frame of the day. The dollar keeps rising against the lira at a slow pace, as the pair trades above the support levels of 19.00, 18.90, and 18.80, respectively.

On the other hand, the price is settling below the resistance level at 19.23, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance level at the integer number 19.50. The price is moving above the moving averages 50, 100, and 200 on the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair.

Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.