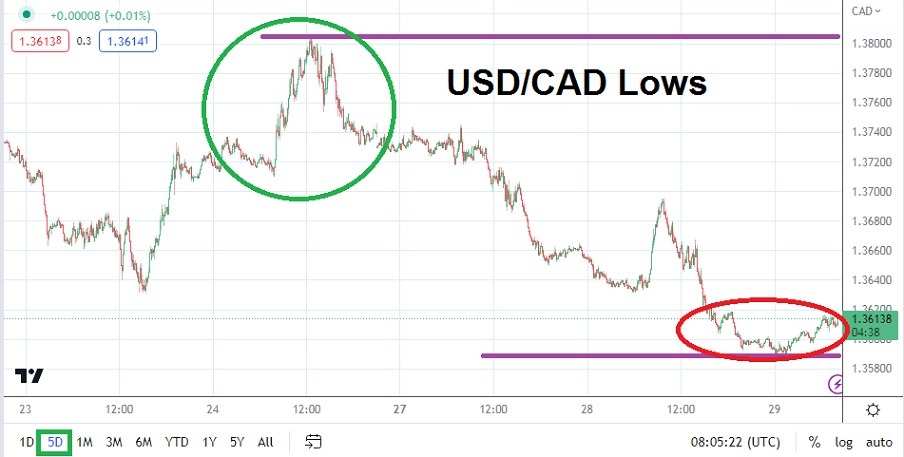

The USD/CAD has continued to display the ability to trade lower early this week, but nervous and volatile results are still being produced which makes pursuing the currency pair rather dangerous. The current price of the USD/CAD is around the 1.36030 mark but touched a low of nearly 1.35885 in early trading this morning. The currency pair is within a price level from late February and early March and that may spur on speculative behavioral sentiment considerations.

The Past Two Weeks of Trading in the USD/CAD have been Dynamic

Fragile global markets have spurred on nervous conditions in Forex and the USD/CAD has certainly mirrored many results. The ability of the USD/CAD to come down from a high of nearly 1.38600 which was demonstrated on the 10th of March has been a solid result for speculators who believed the currency pair had been overbought. However, nervous market conditions because of fears generated via the corporate banking sector still exist and should be given consideration.

Results the past few days have produced more tranquil trading in the broad markets and the calmer conditions have helped the USD/CAD exhibit some selling. The U.S. Federal Reserve which caused a lot of nervous USD/CAD buying in the month of February because of its aggressive rhetoric has momentarily been quieted. If financial institutions are correct about the U.S. central bank not being able to raise interest rates significantly in the mid-term, the USD/CAD may continue to track slightly lower.

Day Traders need to Remain Vigilant for Sudden Impetus in the USD/CAD

- The U.S. will release Gross Domestic Product numbers tomorrow.

- Canada will release its GDP statistics on Friday. The results from the U.S. and Canada could provide fireworks if the outcomes surprise financial institutions.

The near-term for the USD/CAD should be monitored to see if the currency pair can maintain its current values. If the USD/CAD is able to creep towards the 1.36000 ratio and below and maintain this vicinity, traders may be inclined to believe the currency pair is showing an indication that more bearish sentiment is going to be generated.

However, traders need to continue to pay attention to developing news regarding the corporate banking sector, if tranquil market conditions persist this could help the USD/CAD to test lower values. There are no guarantees. Tomorrow’s U.S. growth numbers and the statistics from Canada on Friday will also play into the trading results that will come. Speculators who are optimistic and believe calmer conditions will prevail might be tempted to pursue selling positions in the USD/CAD near term, but risk management will be essential.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.36125

Current Support: 1.36000

High Target: 1.36650

Low Target: 1.35750

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex brokers in Canada for you.