Today's Recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from 19.00 levels.

- Place a stop loss point to close below 18.85 levels.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the strong resistance level at 19.50.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05

The price of the TRY/USD varied during early trading this morning, after the dollar pair against the lira recorded new highs at the end of last week, after the decision of the Turkish Central Bank to install the interest rate last Thursday at 8.5%. The pair is trading around a new average price, after settling for several months below levels of 19 pounds per dollar. Investors followed reports about increasing the minimum pension in Turkey from 5,000 to 7,500, as part of the efforts of the ruling party and the Turkish president to attract more supporters, less than two months before the crucial elections expected in May.

A report issued by the World Bank previously warned of increased spending by the Turkish government in the run-up to the elections in a country already suffering from high levels of inflation. The ruling party seeks to woo the angry voters amid the country's record trade deficit, which rose by 44%, with the futility of the unconventional monetary policy pursued by the ruling party in Turkey, which is based on raising exports through a weak local currency, which has damaged Turkey's balance of payments. The future prospects for the lira do not seem good amid not good economic figures and a decline in the volume of foreign exchange reserves in the country.

TRY/USD Technical Analysis

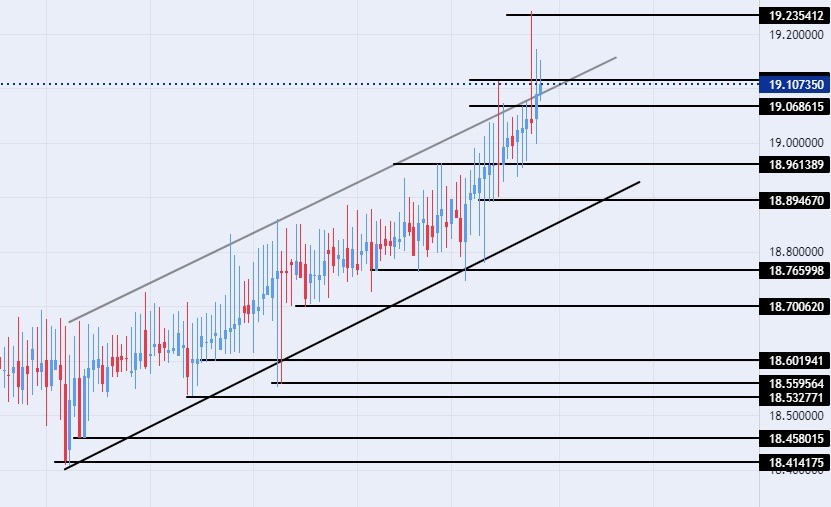

On the technical front, the USD/TRY varied in slight changes during the day's early trading, the pair settled near its all-time high, recording 19.23. It traded at 19.10 levels at the time of writing, with the pair failing to record any closing outside the bullish price channel levels on Today's time frame as of writing, the dollar keeps rising against the lira at a slow pace. The pair is trading above the support levels at 19.00, 18.90, and 18.80, respectively.

On the other hand, the price is settling below the resistance levels 19.11 and 19.23, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at the integer 19.50. The price is moving above the moving averages 50, 100, and 200 in the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair. Because of the divergence in monetary policy and the economic position of Turkey, and fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.