Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.80 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The TRY/USD stabilized during early trading on Thursday morning. Investors followed warnings from Goldman Bank to its clients that there is currently a state of uncertainty in the Turkish markets, which could cause significant risks. Despite the authorities’ efforts to secure a larger number of deposits in Turkish lira through the system approved by the head of state at the end of 2021 under the name of deposits protected in Turkish lira, which succeeded in stopping the lira’s decline temporarily.

The bank’s analysts rule out the success of such initiatives for a long time, especially after the Depletion of the central bank reserves of foreign currencies. It is noteworthy that other reports estimated a strong decline in the volume of the Turkish central cash reserve, which strongly supported the price of the lira in the period following the devastating earthquake that struck the country early last month. The Goldman Sachs report predicted that the lira would witness some strong movements during the coming period, while some other sources suggested a decline in the lira, but after the success of the ruling party in passing the expected elections in May of this year.

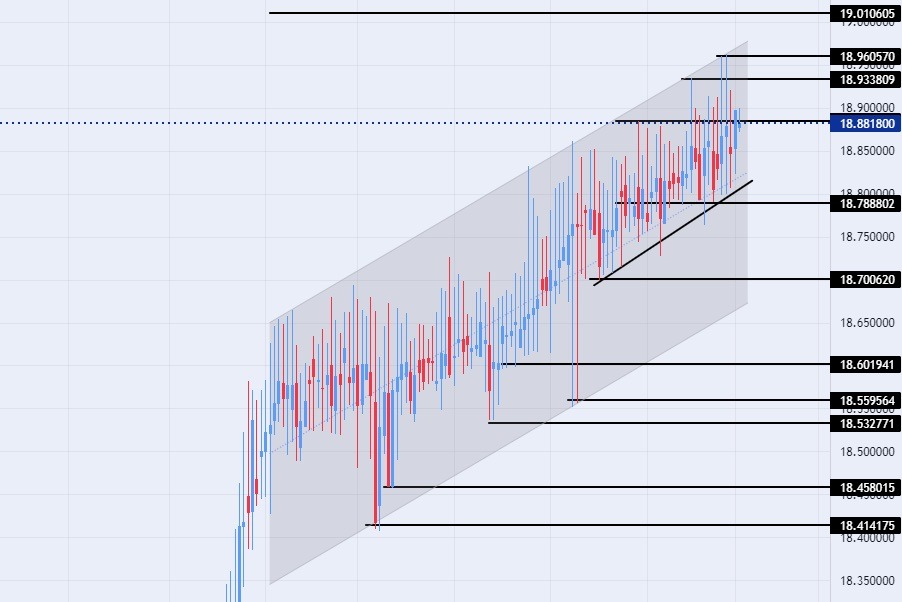

TRY/USD Technical Analysis

On the technical front, trading of the dollar pair against the Turkish lira recorded stability during the day's early trading. The Turkish currency recorded new levels of decline against the dollar at the end of last month after it touched the 18.96 level. At the same time, the pair continued to trade within the levels of the ascending channel in today's time frame, with the pair's bullish movement continuing at a slow pace.

The pair is also trading inside a smaller price channel in the four-hour time frame. The USD/TRY is trading above the support levels of 18.79, 18.70, and 18.63, respectively. The pair is also trading below the resistance level at 18.96, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance level at 19.00.

The USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend on the large time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the slow movement of the pair. Any fall of the USD/TRY represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.