Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

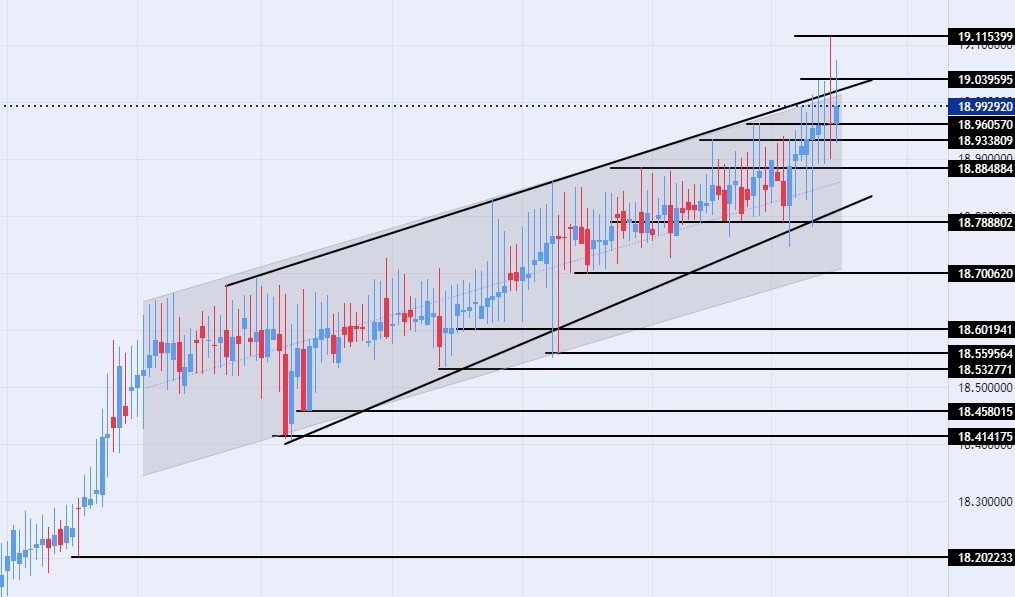

- Entering a buy order pending order from the 18.90 level

- Place a stop loss point to close below the 18.65 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05.

The TRY/USD stabilized, near its lowest levels ever, which were recorded yesterday, amid difficult economic conditions experienced by the Turkish state. The latest data issued in the country revealed that a deficit in the Turkish government budget amounted to $9 billion in February, reflecting the negative impact caused by the devastating earthquake that hit the country last month. The Turkish government injected more support in the wake of raising wages and allowing more room for debt repayments and payments such as taxes.

The decline in government income coincides with the increase in expenditures on the reconstruction of the affected areas, and the government's pre-election incentives, which may increase pressure on the budget. The data stated that the country's foreign exchange reserves declined by about $10 billion during the past month, which reduced the ability of the country's central bank to support the price of the lira, which continued its losses over the past two weeks against the dollar, at a time when the ruling party is facing fateful elections. About two months from now.

TRY/USD Technical Analysis

On the technical front, the USD/TRY varied during the day's early trading, as the pair traded near its all-time high, hitting the 19.11. The pair maintained the general bullish trend, with the pair failing to register any closure outside the levels of the bullish channel on the time frame of the day, as well. It also formed a rising wedge pattern on the daily time frame.

With the pair's upward movement continuing at a slow pace, the dollar against the pound is trading above the support levels of 18.90, 18.80, and 18.70, respectively. It is also trading below the resistance levels at 19.00 and 19.11, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.50.

The pair is trading above the moving averages 50, 100, and 200 in the time frame of today, a sign of the general bullish trend on the large time frame. The price is trading between these moving averages in the 60-minute time frame, a sign of the slow movement of the pair. Any fall of the dollar against the lira represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.