Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.90 level.

- Place a stop loss point to close below the support level at 18.65.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.50 level.

- The best points to place a stop loss close at the 19.65 level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips, and leave the rest of the contracts until the support level at 19.05

The TRY/USD fell, as the pair recorded its highest levels ever. The pair maintained the general bullish trend, as the pound's successive losses continued throughout the current month. Experts suggest that the Turkish Central Bank either lost control of the price of the lira, which is losing successively against the dollar or that the Turkish Central Bank aims to leave the lira to new low levels before controlling the situation and imposing stability after reaching the target levels. It is noteworthy that the Turkish Central Bank has lost about 10 billion dollars in foreign exchange reserves, since the earthquake that struck the country last month, which left more than 45,000 human victims, while financial losses were estimated at more than 35 billion dollars.

Meanwhile, reports of a $5 billion deposit from the Saudi Fund for Development (SFD) entering the accounts of the Turkish Central Bank last Monday failed to support the lira. The Turkish lira lost 30% of its value in 2022, with the Central Bank's continuous intervention to support the lira.

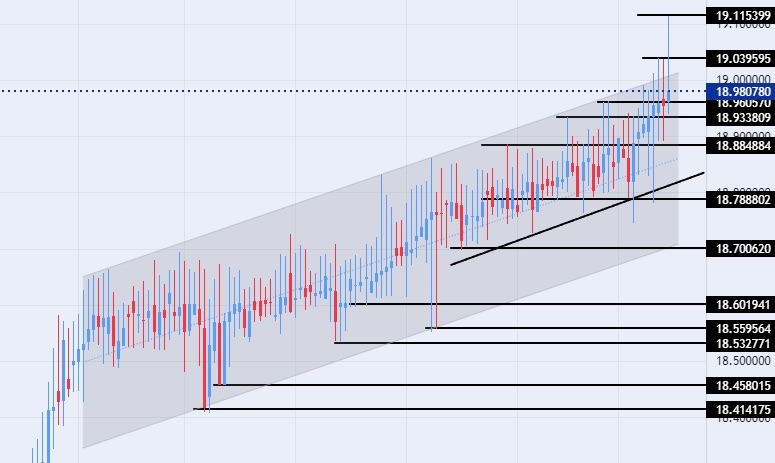

TRY/USD Technical Analysis

On the technical front, the USD/TRY traded higher during today's early trading, as the pair recorded its highest level ever, recording at 19.11. The pair maintained the general bullish trend, as it continued trading within the levels of the ascending channel on the time frame of the day, while the pair broke the price channel. The other is bullish on the four-hour time frame. With the pair's upward movement continuing at a slow pace, the dollar against the pound is trading above the support levels of 18.90, 18.80, and 18.70, respectively.

The pair is also trading below the resistance levels at 19.00 and 19.11, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.50. The pair is trading above the moving averages 50, 100, and 200 on the time frame of today, in a sign of the general bullish trend on the large time frame, while the price is trading between these moving averages on the 60-minute time frame, in a sign of the slow movement of the pair. Any fall of the USD/TRY represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.