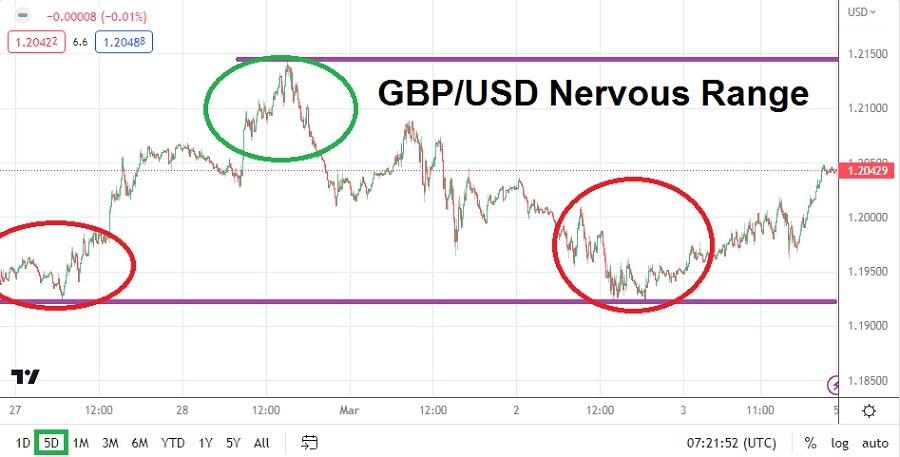

The GBP/USD went into the weekend near the 1.20430 ratio after a rather choppy and nervous display of trading the entire week. A low around the 1.19220 ratio was tested early on Monday and then on Thursday. However, on Tuesday a high near the 1.21445 mark was briefly displayed. Having finished the week of trading within the middle of its five day range, the GBP/USD will certainly provide more nervousness and it has the potential to experience a whirlwind of volatility in the coming days.

U.S Federal Reserve Rhetoric and Employment Numbers are Ahead

Speculators may want to fasten their seatbelts and brace for the possibility the GBP/USD will provide whipsaw results this week. The range of the GBP/USD was nervous last week, but it did maintain its known values and financial houses likely had their eyes focused on the risk events which are lined up in the coming days for the currency pair.

On Tuesday Federal Reserve Chairman Jerome Powell will testify in front of the U.S Senate regarding monetary policy. His comments are sure to be given attention and analysts will try to get a better outlook on the Fed’s perception of the U.S economy, including inflation, growth and interest rate policy. The Fed will certainly raise its key lending rate by another 0.25% on the 22nd of March, but what financial houses want to know is what will happen after this hike. Further hikes are currently anticipated, but some financial houses still have hopes the U.S Fed will become more dovish in the mid-term.

- U.S. jobs numbers will be posted this Friday. The U.K will release Gross Domestic Product numbers on the same day, a handful of hours ahead of the U.S Non-Farm Employment Change data.

- The combination of U.S Fed rhetoric and economic data which will follow later this week is sure to cause a swirl of volatility in the GBP/USD and traders must be ready.

The GBP/USD Ability to Climb above the 1.21400 Ratio Early Last Week is Intriguing

Yes, the GBP/USD hit its low for the week twice, but it also managed to produce some solid price velocity upwards on Tuesday. The move higher is an indication that some bullish perspectives likely remain among financial institutions which are thinking long-term. Day traders do not have this advantage while making quick hitting wagers, but the notion that sentiment still exists which can cause upwards momentum is intriguing.

However, for the GBP/USD to produce a solid trajectory higher that can be sustained, it would need to get ‘dovish’ comments from the Fed Chairman Jerome Powell this week and weaker U.S jobs numbers. This may not be so likely and traders should be ready for the potential to see support levels tested again in choppy conditions. Powell is likely to express caution regarding inflation. And traders should remember U.S Non-Farm Employment Change data was better than expected last month.

GBP/USD Weekly Outlook:

The speculative price range for GBP/USD is 1.18775 to 1.21805

Traders are advised to be cautious this week and make sure their risk management tools are fully in force. The tests of lows last week and reversals higher may be viewed optimistically by bullish traders, but it could also be a signal that if lows are tested again they could be penetrated this time around.

If the GBP/USD falls below 1.20000 early this week and remains near this juncture going into the testimony from Jerome Powell on Tuesday, expect volatility as a definite byproduct of the Fed Chairman’s rhetoric. If the 1.19700 to 1.19500 ratios begin to be challenged, a waterfall could occur which targets the 1.19000 ratios. If this collapses a retest of January lows could develop rapidly. If U.S. job numbers are strong late in the week, this could set off violent trading in the GBP/USD.

For the GBP/USD to get sustained bullish activity this week, Fed Chairman Powell will have to sound more dovish. Less aggressive words from Powell are doubtful, but if he sounds cautious and suggests the Fed could change its direction looking forward, this may be helpful for a higher GBP/USD. If U.S jobs numbers are weaker on Friday, this could also spur on buying of the GBP/USD and a retest of the 1.21400 realms and beyond.