WTI Crude Oil (US Oil)

The West Texas Intermediate Crude Oil market displayed reluctance to move during Thursday's trading session. This is unsurprising given the considerable selling pressure, which may have exhausted the market. With prices below $70, it is likely that the market will continue to decline toward $65. Any short-term rallies should be viewed as opportunities to sell short, as the world confronts the possibility of a deeper recession than previously expected.

It is worth noting that crude oil is highly sensitive to global economic growth. If growth remains stagnant or slows down, demand for crude oil will likely be limited. As of now, I am not interested in purchasing crude oil, as it has proven to be very difficult, and it now seems as if all rallies will continue to act as an opportunity for short sellers to get involved yet again. Quite frankly, I think we are setting up for something rather ugly when it comes to the global economy, and of course, crude oil will be front and center.

Brent (UK Oil)

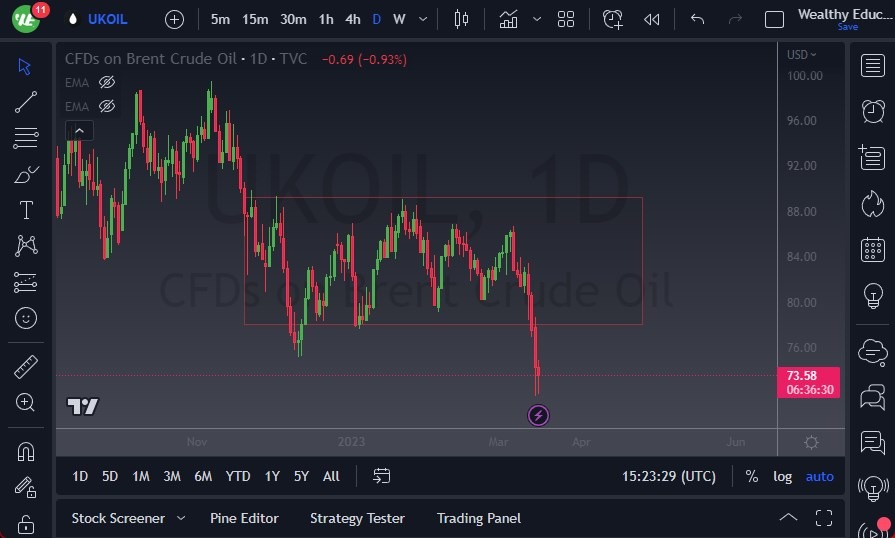

- The Brent market has been fluctuating during the trading session, indicating weakness as there is no sign of a bear market rebound.

- The breach of the $75 level increases the likelihood of a decline toward $70.

- Any upward movement may present a good selling opportunity, given the sluggish pace of the global economy. Alternatively, the market may attempt to price in any signs of strength.

A breakdown below the bottom of Wednesday's candlestick could lead to a drop below $70, potentially triggering a significant downward trend. Any rally at this point is vulnerable, particularly as the 50-Day EMA is starting to trend lower and the $77.50 level above is a significant resistance level. As of now, buying oil appears unwise as there are so many things out there working against the economy. Of note would be the Credit Suisse bailout that’s currently going on in Switzerland, suggesting that there could be more trouble ahead for those who are paying attention.

Quite frankly, at this point, it’s difficult to imagine a scenario where crude oil starts to take off unless the US dollar starts to tank quite rapidly. That seems to be unlikely since there are so many people out there throwing money at the bond market in America.

Ready to trade WTI/USD? Here are the best Oil trading brokers to choose from.