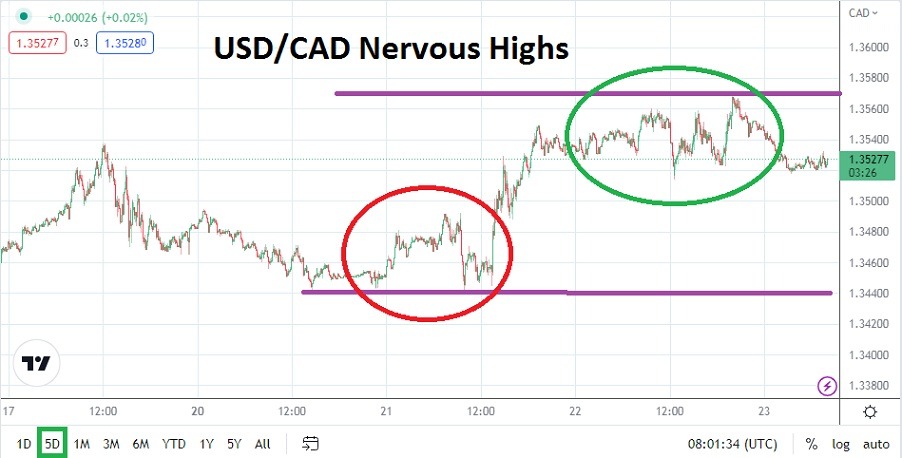

The USD/CAD is trading near the 1.35300 ratio with swift price action early this morning. The currency pair remains near important short and mid-term highs, as financial houses continue to demonstrate a considerable amount of nervousness due the notion the U.S Federal Reserve will remain in an aggressive monetary policy stance. On the 2nd of February the USD/CAD was trading near the 1.32625 realm and those days are starting to feel far away for traders who had a bearish perspective.

The USD/CAD has correlated to the Broad Forex Market

The U.S Gross Domestic Product numbers will be released today and this will cause more volatility to quickly hit the USD/CAD. The highs being tested have remained under early January apex values, but if the U.S growth numbers come in better than expected today this mid-term technical resistance could disappear rather fast.

The USD/CAD like most other major currency pairs was demonstrating a sincere amount of bearish over the mid-term until the start of February. However following in the footsteps of aggressive rhetoric from the U.S Federal Reserve on the 1st of February, bearishness has turned into bullishness also fueled by strong job numbers and stubborn inflation reports from the States.

Some financial houses and speculators likely remained skeptical about the ability of the U.S central bank to raise interest rates in a more aggressive fashion until the middle of last week. When the CPI and PPI data was released this skeptical nature turned into fear. On Tuesday of last week the USD/CAD sunk to the 1.32750 ratio briefly, but then started to rocket higher when data confirmed the U.S Fed’s rhetoric.

Stronger U.S Growth Numbers today could Spell Surrender

- If the U.S Preliminary GDP numbers come in stronger than expected the USD/CAD could ignite higher again and start to challenge early January values quickly.

- Traders must be braced for certain volatility today if the growth numbers are stronger than expected or weaker.

The USD/CAD along with the broad Forex market has watched as the USD has gotten stronger with a good deal of surprise. However, if the GDP numbers from the U.S are better than anticipated today, this will set the table for the U.S. Fed to have more reasons to remain quite hawkish regarding interest rate policy and perhaps raise borrowing rates consistently over the next handful of months.

Only a few weeks ago many financial houses didn’t think the U.S. central bank could remain aggressive. If the growth numbers come in weaker than anticipated today the USD/CAD could see a sharp reversal lower, if doubt is recast on the Fed’s outlook. Risk management is urged for today and tomorrow as financial houses react to the coming data. Existing nervousness in the broad Forex market is high.

Canadian Dollar Short-Term Outlook:

Current Resistance: 1.35460

Current Support: 1.35170

High Target: 1.36660

Low Target: 1.34150

Ready to trade our Forex daily analysis and predictions? Here are the best Canadian online brokers to start trading with.