Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

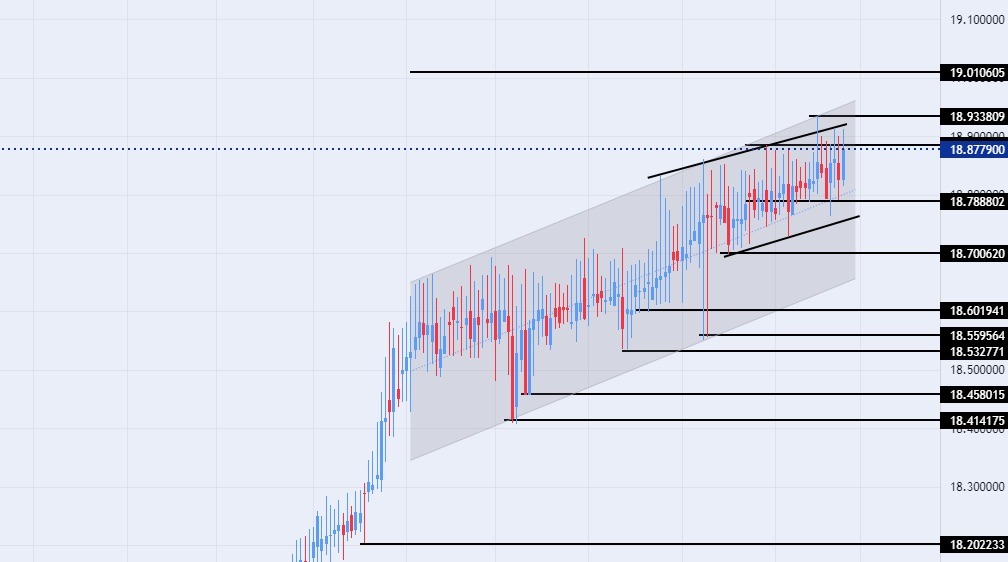

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

Early trading of the TRY/USD stabilized this morning, investors are awaiting the Turkish Central Bank's decision on the interest rate, experts expected that the interest rate would be fixed without changes. The Turkish Central Bank had cut interest rates since the last meetings of last year by about 5%, to stabilize rates at 9% levels, based on the desire of President Recep Tayyip Erdogan, who dominates the monetary policy of the Central Bank of Turkey.

The central bank is not expected to make any change in light of the bank's suffering from a decline in the volume of cash reserves during the past two weeks, amid reports that the central bank used reserves worth $7 billion to stabilize the currency in the wake of devastating earthquakes, and that reserves may remain under pressure.

USD/TRY Forecast

On the technical front, trading of the USD/TRY stabilized during today's early trading, after the Turkish currency recorded new record levels of decline against the dollar at the beginning of last week when it touched the 18.94 level. At the same time, the pair continued to trade within the bullish channel levels on today's time frame, with the pair continuing its bullish movement, albeit at a slow pace. The pair is also trading within a price channel in the smaller time frame.

The USD/TRY is trading above the support levels of 18.78, 18.70, and 18.63, respectively. The pair is trading below the resistance levels at 18.88 and 18.94, which represents the pair's all-time high, and the pair is also trading below the psychological resistance levels at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.