- Spot natural gas prices (CFDS ON NATURAL GAS) deepened their losses during their early trading on Monday, to record new daily losses until the moment of writing this report by -0.72%.

- It settled at a price of $2.480 per million British thermal units, after its decline during Friday’s trading by -2.57%. Last week the price decreased by -17.50%.

Natural gas futures continued the sell-off on Friday, as an expected increase and possible rebound in production over the weekend put pressure on prices. The Nymex March natural gas contract closed the week at $2,410 per million British thermal units, a loss of 4.6 cents a day. April futures contracts fell 4.2 cents to $2,480.

Some of the coldest weather in history continued over the weekend on the East Coast of the United States, but a rapid rise in temperatures should follow for most of the southern 48 states. The widespread bitterness that has hit the country in recent days, but also the sharp decline in production that occurred as a result of the freeze.

On Friday, Bloomberg reported US dry gas production at 97.6 billion cubic feet per day. Indeed, this is an increase from the lows of 96 bcfd seen in recent days. Moreover, if the sustained recovery in production is anything like the one in December, it must be rapid given the expected rise in temperatures.

Earlier, the US Energy Information Administration's (EIA) latest inventory report showed that storage is in strong condition, with inventories down by 151 billion cubic feet for the week ending January 27 to 2,583 billion cubic feet, although the weekly draw came in larger. Slightly more than expected, inventories were 222 billion cubic feet above the previous year's levels and 163 billion cubic feet above the five-year average.

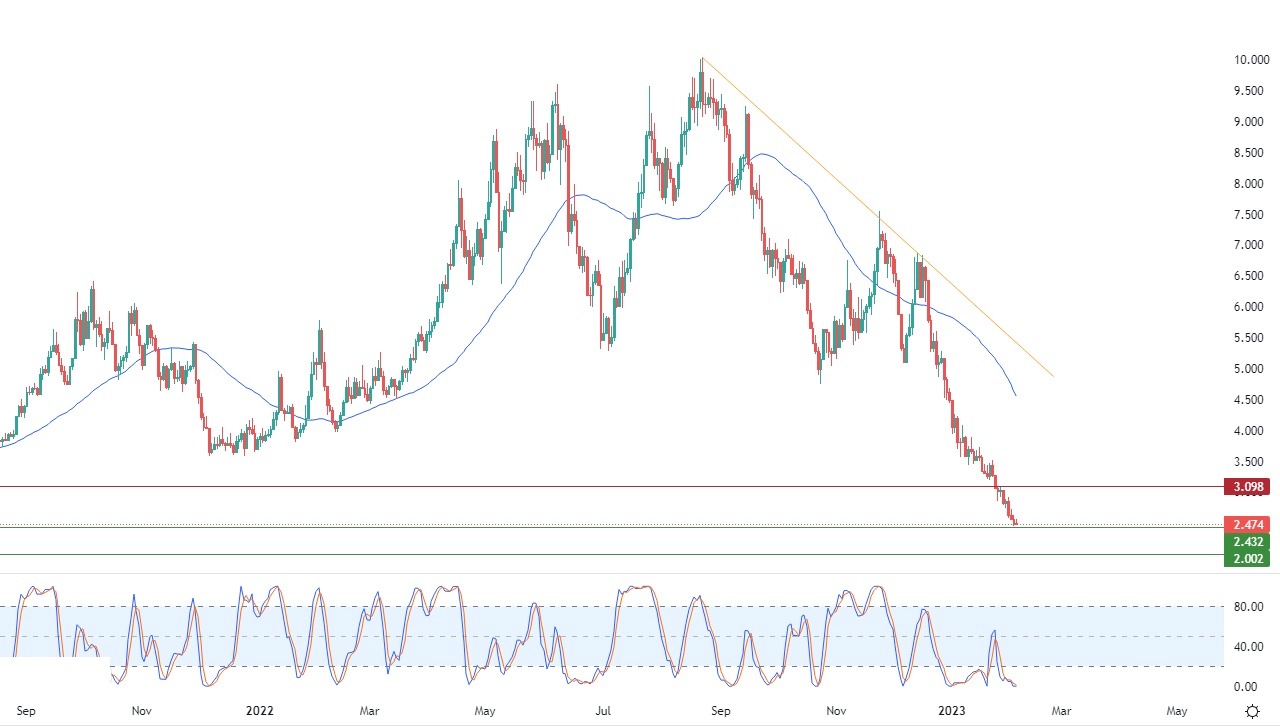

Natural Gas Technical Analysis

Technically, the price continues its decline amid the dominance of the bearish trend in the short term and along a slope line, as shown in the attached chart for a (daily) period of time, with the presence of negative signals in the relative strength indicators. This happened despite its stability in highly saturated areas with selling operations and considering the continued negative pressure for its trading Below the previous 50-day simple moving average.

Therefore, our negative expectations remain in effect in the short term, as we expect natural gas to continue declining during its upcoming trading, especially if it breaks the current 2.432 support, to then target the 2.00 support level.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.