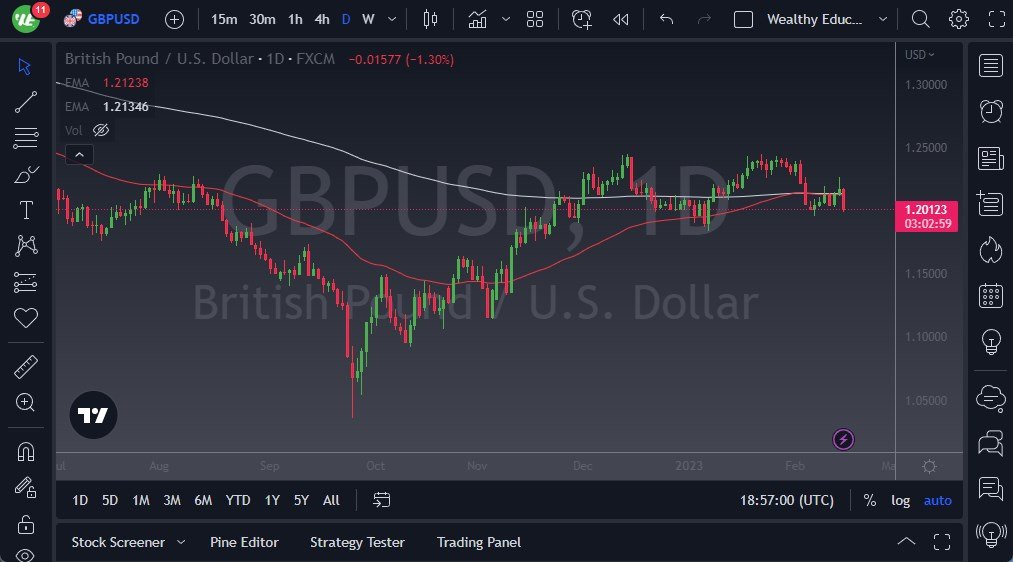

- The GBP/USD currency pair has fallen during the trading session on Wednesday again, as we continue to threaten the 1.20 level.

- The markets continue to be very noisy, and I do think that we continue to look at this through a risk appetite perspective.

- Ultimately, this is a market that I think given enough time probably breaks down, perhaps opening up a move down to the 1.1850 level.

- 1.1850 level is an area where we had seen support previously, but I do think that it is probably an area that would get broken if we do in fact pressure it.

Dollar Continues to Strengthen

On the other hand, we could continue to consolidate, perhaps try to reach to the top of the shooting star from the previous trading session. That would obviously be an area of concern, and I think would be difficult to break above. If and when we do break above there, then you’ve got quite a bit of momentum in the market, and it’s likely that we could really start to take off. At that point, I would anticipate the 1.24 level would offer significant resistance extending to the 1.25 level. The 1.25 level is an area where we have seen noise and a lot of selling pressure, so I think it would be difficult to get above there. Quite frankly, that would be a Herculean effort just waiting to happen as it would not only break above a double top, but a large, round, psychologically significant figure that has meant quite a bit of order flow in the past.

If we do drop below and go to the 1.15 level, via the 1.1850 level, then I think you will see the US dollar pickup quite a bit of momentum in general, and that we should continue to see more of a “risk off move.” I don’t necessarily think that is going to be the case, but if it does in fact happen it’s likely that we will see the US dollar strengthened against almost everything, not just the British pound. Having said that, the British economy is a bit precarious at the moment, so it should continue to see the British pound underperform in general. The market should continue to behave the same way, so I think that this candlestick was the beginning of something bigger.

Ready to trade our Forex daily analysis and predictions? Here is the best forex trading platform UK to choose from.