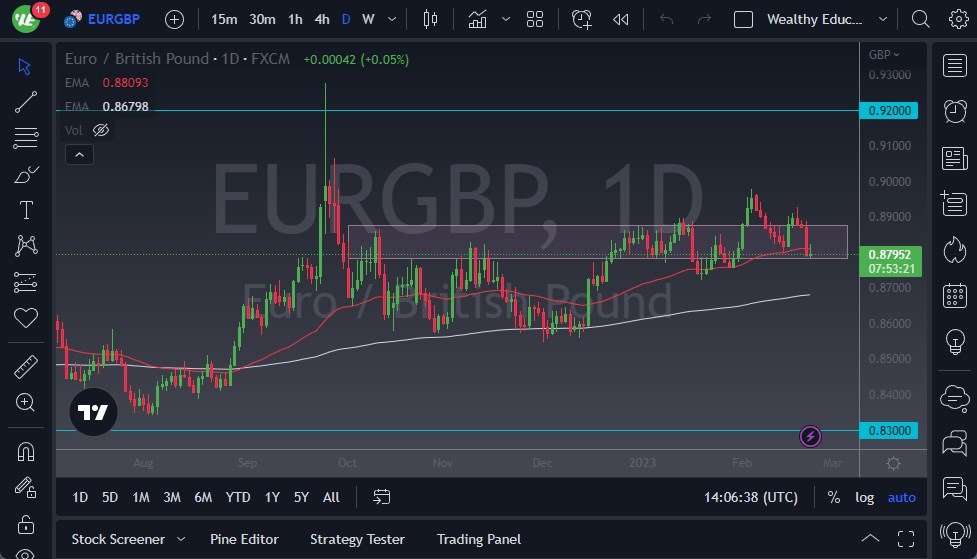

The EUR/GBP pair has rallied to slightly during the early hours on Wednesday but gave back early gains as we hit the 50-Day EMA. Furthermore, you should keep an eye on the fact that there was such a negative candlestick during the previous session, as the PMI indicators out of the United Kingdom are much stronger than the European Union, so therefore people are starting to bet that the Bank of England will have to continue to be very tight, and perhaps start to focus on raising interest rates again.

It Will All Come Down to Central Banks Decisions

While that is possibly nonsense, the reality is that the currency market is based on a relative basis. In other words, people are betting that the ECB will have to back off much quicker than the BOE will. If we break down below the area we are trading at right now, we could see the market drop down toward the 200-Day EMA, near the 0.87 level. The 0.87 level is an area that has seen action previously, and therefore I think you need to look at this through the prism of a market that continues to be noisy, but that’s the normal action in this pair in general as the 2 economies do so much business with each other.

- On the upside, the 0.89 level should be resistance, right along with the psychologically important 0.90 level.

- When you look at the action over the last several months, you can see just how choppy this market has been, but over the longer term it has been slightly bullish.

- The question now is whether or not we have changed momentum?

I do not think that’s the case, but it’s very possible that we at least have to revisit the 200-Day EMA. The biggest use I have for this chart is to give us an idea which one of will perform better or worse against the US dollar, which of course you can extrapolate to 2 of the biggest currency pairs in the world, the EUR/USD pair, and the GBP/USD pair. It’s a process I call triangulation, where I look at which one is performing better than the other, and then pick a direction with the US dollar. This is a way to get better returns than simply trading just one chart. As far as this market is concerned, patience will be needed.

Ready to trade our Forex daily forecast? We’ve shortlisted top forex brokers uk in the industry for you.