Bullish view

- Buy the BTC/USD pair and set a take-proft at 23,577.

- Add a stop-loss at 22,500.

- Timeline: 1-2 days.

Bearish view

- Set a sell-stop at 22,800 and a take-profit at 21,000.

- Add a stop-loss at 23,500.

Bitcoin price moved sideways on Tuesday as the market pondered the next action plan by the Federal Reserve following the strong jobs numbers on Friday. The BTC/USD price was trading at 23,000 on Tuesday as the US dollar index (DXY) crawled back above $103.

Bitcoin’s muted activity

Bitcoin’s recent performance has mirrored that of American equities. On Monday, the Dow Jones and the Nasdaq 100 indices continued their sell-off that started on Friday. They then turned positive before the market closed.

The most important catalyst for Bitcoin was the tight labor market that gave the Federal Reserve breathing space for more hikes. In its decision last week, the bank decided to hike interest rates by 0.25% and pointed to more increases in the future. Therefore, the strong jobs numbers could push the bank to continue with its increases in the coming meetings.

Meanwhile, activity in the Bitcoin market remains relatively calm. Data shows that longs and shorts liquidations have been relatively balanced in the past few days. On Monday, longs liquidated positions worth about $8.47 million while shorts liquidated $8.87 million. At the same time, Binance inflows rose by $227 million in the past 24 hours.

BTC/USD forecast

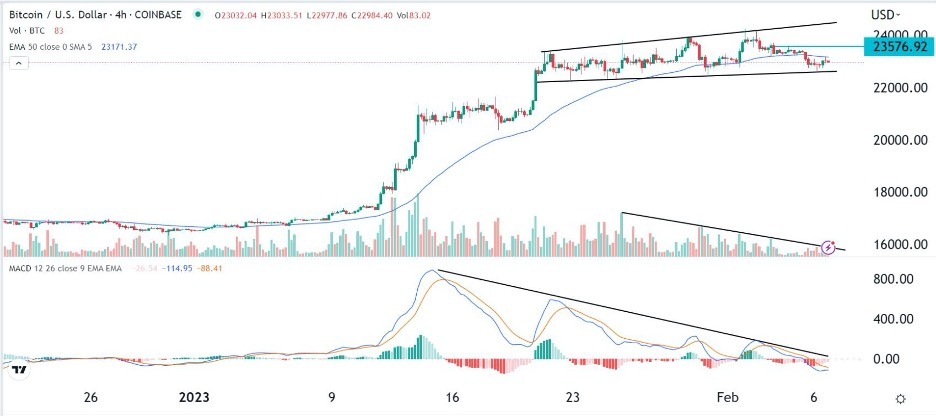

Bitcoin dropped to the important support level at $22,660 on Monday. This was a crucial level since it was the widening black channel. Its lower side connects the lowest points since January 22nd. The pair then formed a small gravestone doji pattern, which is usually a reversal signal. A look at volume flows shows that the overall volume has been in a downward trend after it peaked on January 25.

Meanwhile, the MACD indicator has moved below the neutral line. Histograms and the two lines have continued falling, causing a bearish divergence pattern. In technical analysis, this divergence pattern is usually a bullish sign. It has also formed a rising broadening wedge pattern while the price has dropped below the 50-period moving average.

Therefore, the outlook for the BTC/USD pair is bearish although a brief recovery is possible on Tuesday as some investors buy the dip. If this happens, the next logical point to watch will be at 23,576 (February 4 high). A drop below the support at 22,660 will open the possibility of the pair drifting to the support at 20,000.

Ready to trade Bitcoin in USD? We’ve shortlisted the best crypto brokers in the industry for you.