Today's recommendation on the USD/TRY

The risk is 0.50%.

Best buying entry points

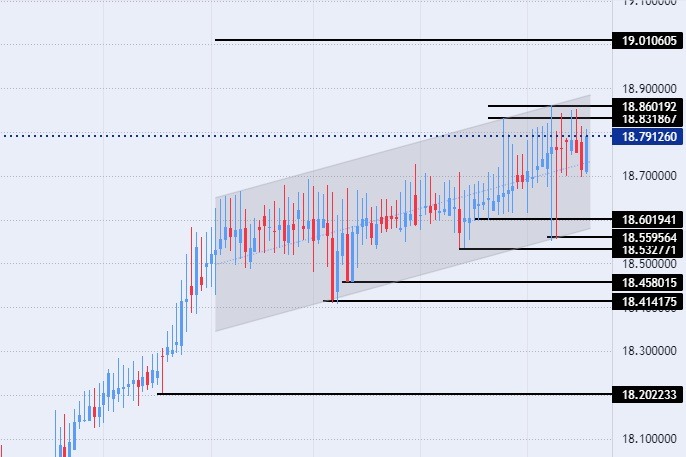

- Entering a buy order pending order from the 18.60 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The price of the TRY/USD stabilized during early trading this morning, Wednesday, amid the absence of data, which no longer has an impact on the movement of the Turkish currency price. This happened considering the Turkish Central Bank's control over the movement of the lira and its keenness to support it against the dollar.

The central bank’s intervention to support the weak lira appears after the US dollar declined globally after inflation data was released last week. Inflation in the United States fell to 6.5% in December compared to 7.1% recorded in November, as the dollar retreated amid the Federal Reserve’s tendency to ease the pace raise interest. On the Turkish side, the positive statements continued by the Turkish Finance Minister, Nurettin Nabatai, who said that all economic data are showing progress except for inflation, which has started to decline recently.

These are similar statements to those of the Turkish President, Recep Tayyip Erdogan, who said that we will soon see a decrease in inflation. In terms of data, official data showed a decline in real estate sales in Turkey during the past year by 4%, as experts attributed this decline to the high cost of purchase and high inflation.

TRY/USD Technical Analysis

On the technical front, the trading of the USD/TRY stabilized without change, as the pair witnessed fluctuations near its all-time highs, as the pair maintained its trading within the levels of the bullish channel on today's time frame. The pair appears to rise, albeit at a slow pace.

Currently, the USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.00. At the same time, the USD/TRY is trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair.

Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.