Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

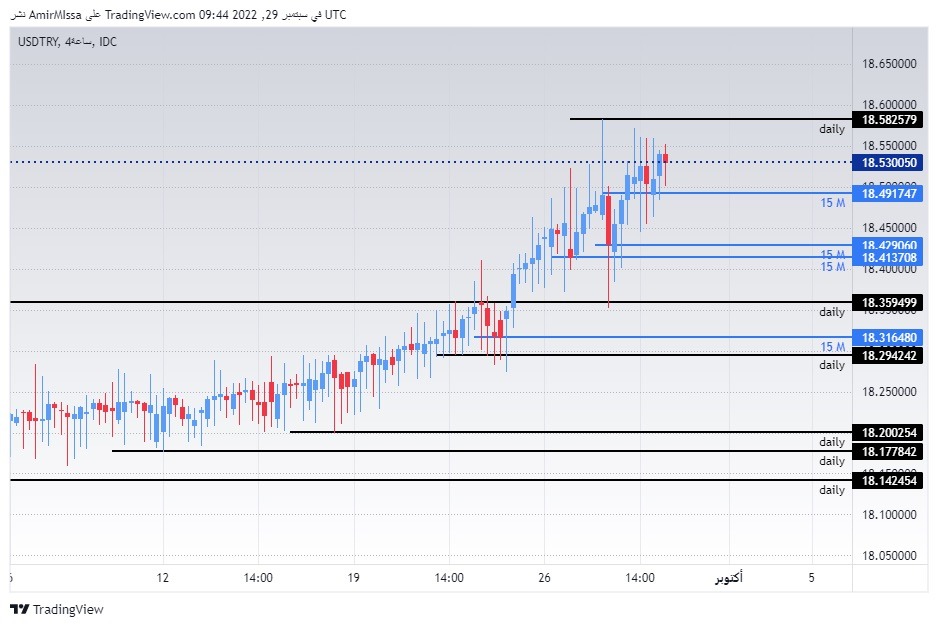

- Entering a buy order pending order from the 18.60 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The TRY/USD has stabilized against the dollar near its all-time lows, which were recorded at the end of last year. The lira did not benefit from the positive data that was issued yesterday, as the annual inflation rate recorded the fastest rate of decline after it fell from 85% levels last November, recording 64.3% levels during December.

After the statements, Turkish Finance Minister Noureddine Nabatai made statements in which he stressed the government's success in reducing inflation rates by following some of the control measures that included strict inspection of the markets. Inflation had recorded record levels in Turkey with the combination of several factors, the most important of which was the rise in the prices of energy imports. This follows the Russian invasion of Ukrainian lands, as well as the weakness of the Turkish lira as a result of the stimulus monetary policy pursued by the country's central bank.

It is noteworthy that the gas supply agreement between Russia and Turkey has eased energy price pressures, as well as the indirect measures followed by the Turkish Central Bank. This is restricting commercial banks in the lending policy, in addition to pumping more foreign currency into the markets, which has contributed to stopping the bleeding of the Turkish lira, which has lost nearly 30 percent of its value over the past year.

TRY/USD Technical Analysis

On the technical front, the dollar pair stabilized against the Turkish lira, recording slight changes. The pair traded inside a rising wedge pattern in today's time frame, as it settled in the same limited trading range that it has been trading around since mid-October. Currently, the USD/TRY is trading above the support levels of 18.61 and 18.50, respectively.

On the other hand, the pair is trading below the resistance level at 18.83, which represents the highest price for the pair recorded in 2022. The pair is also trading below the psychological resistance levels at 19.00. The dollar pair against the lira is also trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, as well as the lower time frames, indicating the general bullish trend of the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.