Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

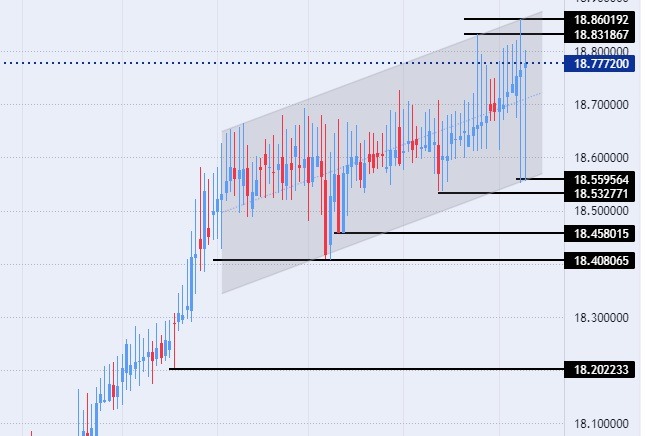

- Entering a buy order pending order from the 18.60 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The exchange rate of the TRY/USD recorded a strong movement over the past two days. Where the Turkish lira recorded new lows against the dollar, amid a movement believed to be strong speculation that did not continue amid the Turkish Central Bank's control of the exchange rate.

In terms of data, investors followed the statement of the Turkish Statistical Office, which showed that the unemployment rate stabilized on a monthly basis at 10.2% last November, which is the same rate recorded during the previous month. At the same time, investors followed the statements of the Turkish President, Recep Tayyip Erdogan, whose economic promises continued about further reducing inflation. the program will target inflation levels, which aims to reach 20 percent.

It is noteworthy that the Turkish president follows a new economic model, according to his statements, as it aims to reduce inflation by lowering interest rates to increase loans that increase investment and production projects. The Turkish Central Bank had cut the interest rate over the past year from 14% levels at the beginning of the year to 9% levels by last November.

USD/TRY Technical Analysis

On the technical level, the USD/TRY recorded a big movement through which the pair recorded record level. The pair broke through the limited trading range, albeit temporarily, before returning to the same levels again, for the pair to settle within the levels of the ascending channel on the time frame of the day

The pair continues to rise albeit at a slow pace. Currently, the dollar pair against the lira is trading above the support levels of 18.60, 18.55, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.00.

The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, and the lower time frames, indicating the general bullish trend of the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.