Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the 18.45 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The price of the TRY/USD stabilized against the dollar during early trading this morning, and at the end of last week. The Turkish Central Bank issued its decision to fix the interest rate for the second month in a row at 9%, as it seems that the monetary policy board in the bank has reached its temporary goal of reducing the interest rate Interest to the level of singles, which is the same desire of the Turkish president.

The economic data on inflation also reflected an improvement during the month of December, after inflation fell from 85% to about 64%. Meanwhile, the Turkish president announced that the Turkish presidential elections would be held on May 14, before the date was officially announced next March. Meanwhile, official agencies in Turkey announced today that the Turkish cabinet meeting today, chaired by President Recep Tayyip Erdogan, is expected to result in some important decisions in the economic sector, including the largest package of restructuring and a grant, which the report described as the most costly in the history of the Turkish Republic. Others about debt relief for citizens related to taxes, insurance, and others.

A previous report issued by the World Bank had warned of large government spending and its negative impact on inflation, in an attempt by the ruling party government to significantly revive the economy ahead of the elections.

TRY/USD Technical Analysis

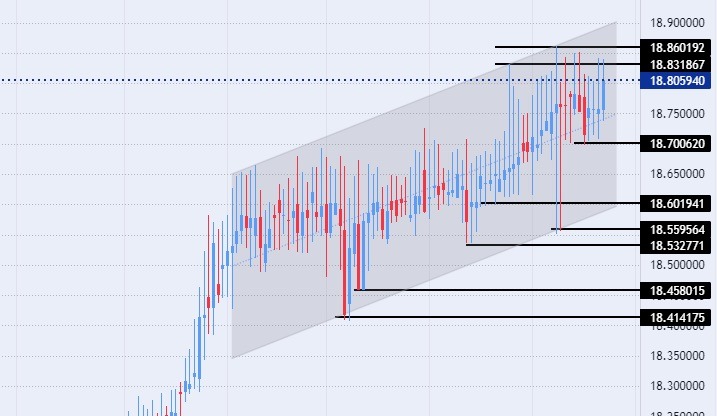

On the technical front, the trading of the USD/TRY stabilized, with almost no changes during today's early trading. The pair witnessed slight fluctuations near its all-time highs, the pair maintained its trading within the levels of the ascending channel on today's time frame, which reflects the upward movement of the pair, albeit at a slow pace. At the same time, the dollar pair against the lira is trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair.

Currently, the dollar against the pound is trading above the support levels of 18.70, 18.60, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.