Spot natural gas prices (CFDS ON NATURAL GAS) settled down during its early trading on Tuesday, achieving slight daily gains until the moment of writing this report, by 0.57%. It settled at $ 2.845 per million British thermal units, after declining during yesterday’s trading by 0.5%. -6.57%.

Natural gas futures settled at their lowest levels since April of 2021, amid expectations of warmer weather in the East Coast and parts of the central regions of the United States. Natural gas prices settled on Thursday at their lowest level since May 2021 and recorded a day Friday, its sixth straight weekly loss.

Warmer weather is likely to dampen demand due to weather and further support the possibility that storage levels will end the winter season with a surplus above the five-year average.

Traders also focused on strong production and expectations of mild weather in mid-February, which sent natural gas futures lower on Monday.

The Nymex gas futures contract for the month of March fell in its first regular session as a spot month by 17.2 cents per day, and settled at $2.677 per million British thermal units. The April contract lost about 14.7 cents to $2.731.

January settled as generally mild and while there were winter storms in December these proved short-lived, leaving the market weak in terms of sustained demand.

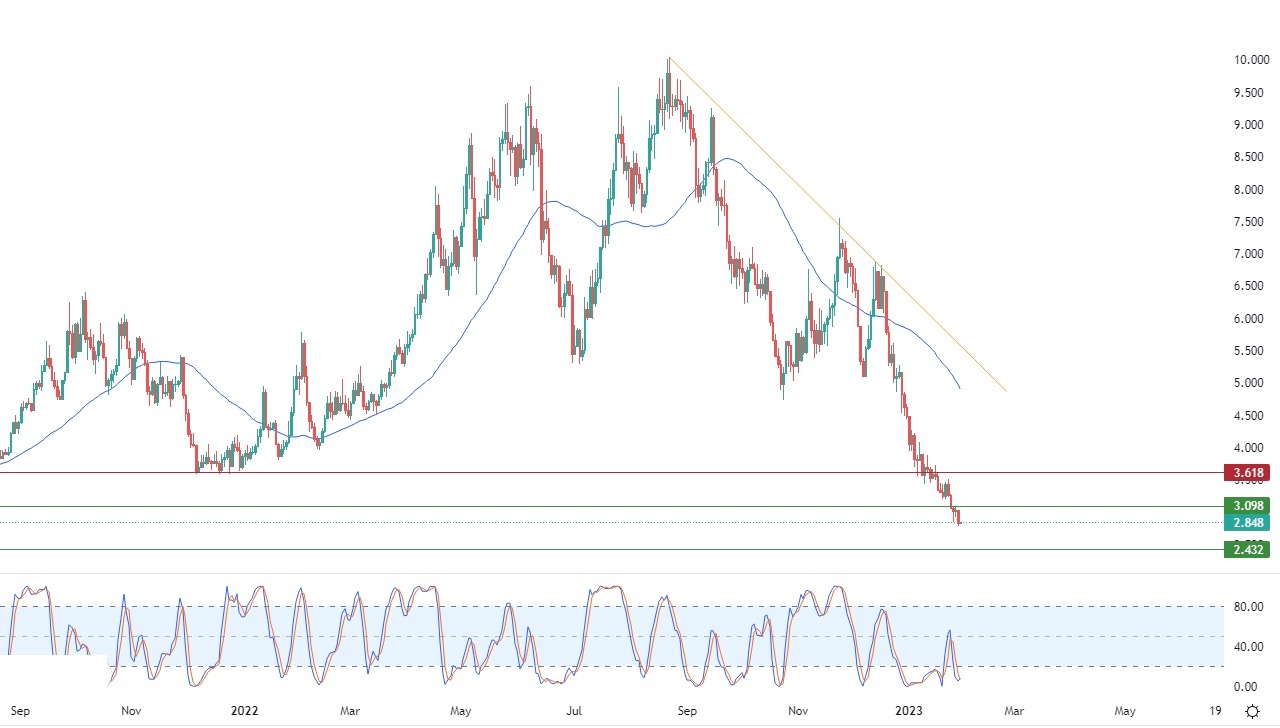

Natural Gas Technical Analysis

Technically, natural gas continues its decline amid the negative signals of the relative strength indicators, despite reaching areas that are highly saturated in selling operations. Negative pressure continued due to its continuous trading below the simple moving average for the previous 50 days, in addition to that the bearish trend dominates the price movements in the short term and along the line Slope, as shown in the attached graph for a (daily) time.

Therefore, our negative expectations surrounding natural gas continue as long as it remains stable below 3.098, targeting the first support levels at 2.432.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.

Ready to trade FX Natural Gas? We’ve shortlisted the best commodity trading brokers in the industry for you.