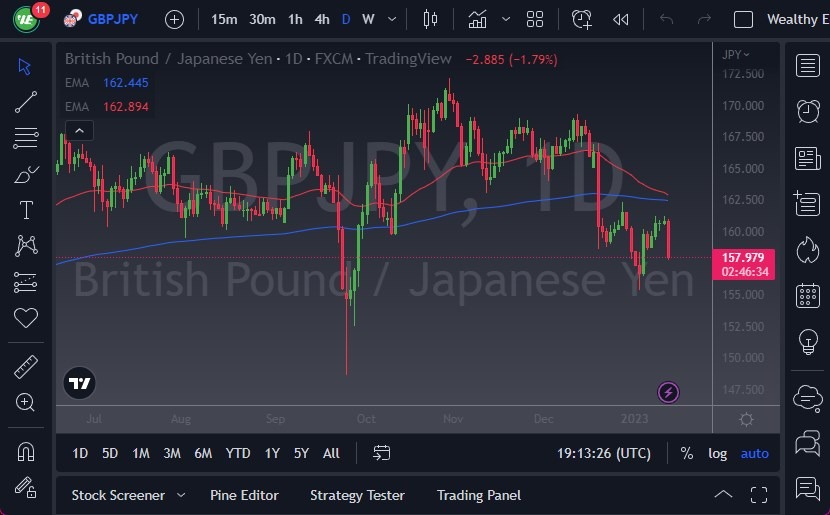

Well, it looks like the markets are at it again. There has been talking about the Bank of England changing its overall monetary policy, and that has people thinking immediately that they are going to allow rates to rise. As a result, the Japanese yen was by far one of the best performers in the Forex world during Thursday. This sent the GBP/JPY pair below the ¥160 level, an area that of course is psychologically important. At this point in time, I think it’s probably only a matter of time before we continue to go lower if there are thoughts of the Japanese tightening monetary policy. However, if they do in fact walk this back, I will anticipate that the yen gets pounded.

Nonetheless, I think we’ve reached the point where it’s obvious that the Japanese yen is done selling off, and we will more likely than not continue to see yen strength. We almost have the “death cross” forming in this pair, when the 50-Day EMA breaks down below the 200-Day EMA forming a very bearish signal for longer-term traders. In that environment, it’s very likely that you will continue to see selling pressure every time we get a bit of news, and therefore I do think that a lot of traders are closely watching this area.

There is Plenty of Selling Pressure

- On the downside, the ¥155 level continues to be important, and more likely than not will offer a bit of support on the way back down.

- Whether or not that into being the case remains to be seen, but it does make a certain amount of sense as we have seen a bounce from that area, and of course, it is a large, round, psychologically significant figure.

- With that in mind, I think that your short-term target, but breaking down through there opens the bottom and we could go all the way down to the ¥150 level rather quickly.

If we do that, you will probably see the yen's strength and across the Forex world. In that environment, I think you will see the great unwinding continue of the yen short that was so popular and so profitable last year. The size of the candlestick for the day certainly suggests that there is plenty of selling pressure and that the momentum is on the side of bearish.

Ready to trade our Forex daily forecast? We’ve shortlisted the top UK forex trading platforms in the industry for you.