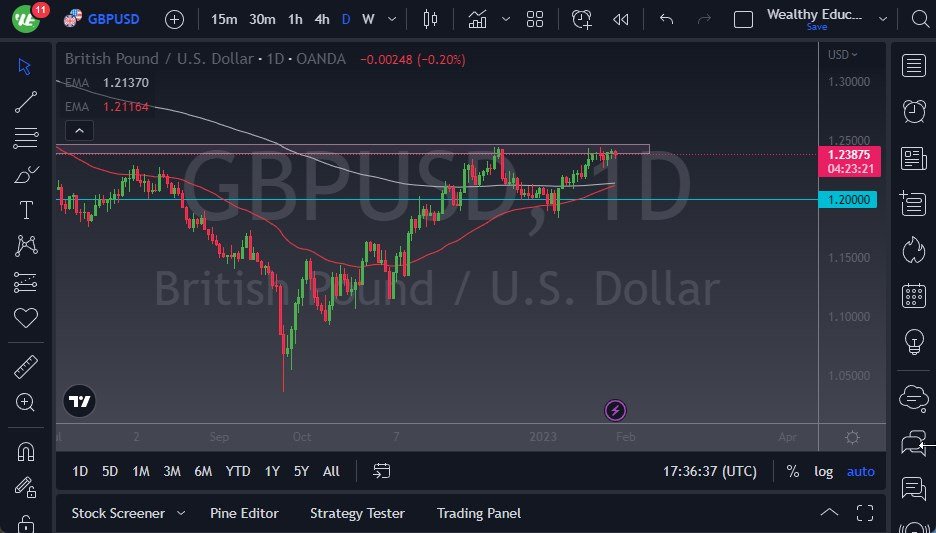

- The GBP/USD currency pair has struggled with the 1.25 level again during the trading session on Friday, as we continue to see a lot of noise in the same manner.

- After all, we continue to see the 1.25 level offer a lot of psychological resistance, and we have not even been able to actually touch that level.

- If we could break above the 1.25 level, then it is likely that the British pound would go much higher, perhaps reaching the 1.2750 level.

Focus on the FOMC Meeting Next Week

The US dollar is struggling a bit as of late, but we have the FOMC meeting next Wednesday that should continue to be in the forefront of where we go next, and as a result it’s likely that we have a lot of volatility ahead of us. After all, the world is trying to figure out what to do with the central bank policy, as it looks like the Federal Reserve has to talk the market back down. After all, a lot of traders out there are betting that the Federal Reserve is going to run out of nerve, and start thinking about either slowing down, or perhaps even pivot later in the year.

It’s likely that Jerome Powell will do everything he can to talk the market back down, as every time he has stated the hawkish intentions of the Federal Reserve, it seems as if the market refuses to believe them. This does make a certain amount of sense considering that the last 14 years have seen nothing but loose monetary policy, and we have an entire generation of traders that have no other frame of reference at this point. Alternatively, I think if he screws up the speech (and let’s be honest here, he could), then you could see the US dollar get absolutely hammered.

I anticipate that he will be as hawkish as humanly possible, just due to the fact that nobody seems to be paying attention and every time asset prices go higher, it works against what the Fed is trying to accomplish. They need inflation to come down, and are willing to fight until he gets down to 2%. We are nowhere near that right now, so I think you continue to see this push and pull dance in the markets. I would not be surprised to see this market pullback to the 200-Day EMA sometime next week.

Ready to trade our daily trading analysis? Here’s a list of regulated forex brokers to check out.